From Data to Deals: Sibco Powers Business Development Strategies for Bankers with IBISWorld

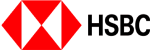

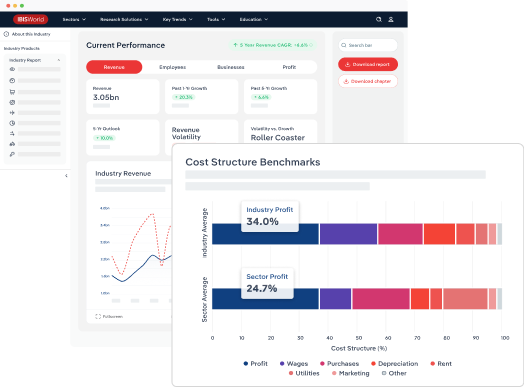

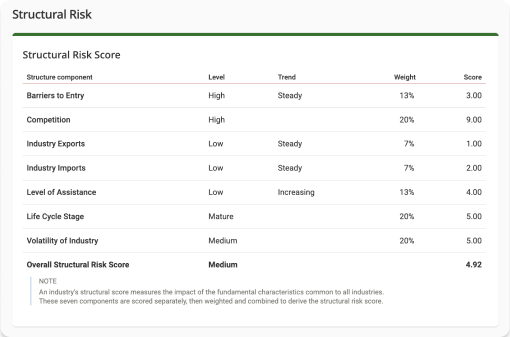

Watch Sibco demonstrate how to leverage IBISWorld's data to craft smarter business development strategies, drive growth, and stay ahead in a competitive market.

Learn more