IBISWorld Platform

Answer any industry question in minutes with our entire database at your fingertips.

Over the five years through 2025, textile retailing revenue is expected to fall at a compound annual rate of 1.1%. Once a favourite pastime, knitting and sewing have fallen out of favour thanks to the internet boom and alternative entertainment like Netflix and scrolling on social media. As media consumption has shot up, traditional hobbies like knitting and making clothing have plummeted, as have fabric and haberdashery sales. The explosion of fast fashion has decimated the textile and fashion sector. Before, stitching up holes and repairing garments were ways to extend the life of clothing items, but this isn’t the case anymore. The popularity of fast fashion means it’s not worth the time or effort to replace a garment when something new can be bought for less than €20. Gen-Z shoppers have a keen interest in individuality and expressing personality through clothing – including making their own – but this market isn’t big enough to offset falls in other areas. People are paring back expenditure on non-essential items like blankets and table linen while household finances remain tight. Inflation has reshaped consumer priorities. Although price growth has moderated since 2022, real incomes remain constrained, prompting households to save more and spend less on non-essentials and consumers increasingly favour budget retailers like IKEA over heritage brands. Demographic trends add further complexity. Delayed independence and overcrowding in many European markets dampen demand for large-format or decorative fabrics, but growth potential lies in compact, modular and affordable product lines tailored to renters and shared households, while markets with earlier household formation still support fuller assortments. At the same time, sustainability has moved centre stage. The EU’s Extended Producer Responsibility scheme, effective from 2025, compels retailers to manage textile waste and redesign products for circularity. Social media accelerates trend cycles and intensifies competition from agile digital players. To thrive, retailers must combine value, sustainability and speed, leveraging digital influence while adapting product strategies to shifting economic and demographic realities. In 2025, revenue is expected to drop 0.8% to €17.4 billion, while profit inches down to 4.8% as competitive and cost pressures grow.Over the five years through 2030, textile retailing revenue is expected to inch up at a compound annual rate of 2.6% to €19.7 billion. Europe’s home textile retailers are reshaping supply chains to boost resilience and meet new sustainability rules. Energy shocks, supply disruptions and regulatory pressure are accelerating nearshoring to Portugal, Romania, Turkey and Bulgaria, cutting lead times, transport emissions and inventory waste while improving traceability. From 2030, Digital Product Passports will make supply chain transparency mandatory, pushing retailers to invest in data systems and traceability infrastructure. At the same time, bio-based fibres and regenerative agriculture are transforming material sourcing. Hemp, lyocell and waste-derived fibres offer lower emissions and compliance advantages, while upcoming EU Green Claims rules demand verifiable sustainability. Early adopters of nearshoring, traceability and sustainable materials will gain speed, trust and competitiveness; laggards face higher costs and regulatory risks.

Answer any industry question in minutes with our entire database at your fingertips.

Feed trusted, human-driven industry intelligence straight into your platform.

Streamline your workflow with IBISWorld’s intelligence built into your toolkit.

IBISWorld's research coverage on the Textile Retailing industry in Germany includes market sizing, forecasting, data and analysis from 2015-2030. The most recent publication was released October 2025.

The Textile Retailing industry in Germany operates under the WZ industry code DE-G4751. The industry includes stores that sell finished textiles (e.g. bedding fabrics, knitting yarn and basic materials for making rugs, tapestries or embroidery), textiles and haberdashery (e.g. needles and sewing thread). Related terms covered in the Textile Retailing industry in Germany include fast fashion, haberdashery and circular economy.

Products and services covered in Textile Retailing industry in Germany include Bedroom and bathroom textiles , Large textiles and Small textiles .

Companies covered in the Textile Retailing industry in Germany include Inter Ikea Systems BV, Jysk A/S and The TJX Companies Inc.

The Performance chapter covers detailed analysis, datasets, detailed current performance, sources of volatility and an outlook with forecasts for the Textile Retailing industry in Germany.

Questions answered in this chapter include what's driving current industry performance, what influences industry volatility, how do successful businesses overcome volatility, what's driving the industry outlook. This analysis is supported with data and statistics on industry revenues, costs, profits, businesses and employees.

The Products and Markets chapter covers detailed products and service segmentation and analysis of major markets for the for the Textile Retailing industry in Germany.

Questions answered in this chapter include how are the industry's products and services performing, what are innovations in industry products and services, what products or services do successful businesses offer and what's influencing demand from the industry's markets. This includes data and statistics on industry revenues by product and service segmentation and major markets.

The Geographic Breakdown chapter covers detailed analysis and datasets on regional performance of the Textile Retailing industry in Germany.

Questions answered in this chapter include where are industry businesses located and how do businesses use location to their advantage. This includes data and statistics on industry revenues by location.

The Competitive Forces chapter covers the concentration, barriers to entry and supplier and buyer profiles in the Textile Retailing industry in Germany. This includes data and statistics on industry market share concentration, barriers to entry, substitute products and buyer & supplier power.

Questions answered in this chapter include what impacts the industry's market share concentration, how do successful businesses handle concentration, what challenges do potential industry entrants face, how can potential entrants overcome barriers to entry, what are substitutes for industry services, how do successful businesses compete with substitutes and what power do buyers and suppliers have over the industry and how do successful businesses manage buyer & supplier power.

The Companies chapter covers Key Takeaways, Market Share and Companies in the Textile Retailing industry in Germany. This includes data and analysis on companies operating in the industry that hold a market share greater than 5%.

Questions answered in this chapter include what companies have a meaningful market share and how each company is performing.

The External Environment chapter covers Key Takeaways, External Drivers, Regulation & Policy and Assistance in the Textile Retailing industry in Germany. This includes data and statistics on factors impacting industry revenue such as economic indicators, regulation, policy and assistance programs.

Questions answered in this chapter include what demographic and macroeconomic factors impact the industry, what regulations impact the industry, what assistance is available to this industry.

The Financial Benchmarks chapter covers Key Takeaways, Cost Structure, Financial Ratios, Valuation Multiples and Key Ratios in the Textile Retailing industry in Germany. This includes financial data and statistics on industry performance including key cost inputs, profitability, key financial ratios and enterprise value multiples.

Questions answered in this chapter include what trends impact industry costs and how financial ratios have changed overtime.

The Industry Data chapter includes 10 years of historical data with 5 years of forecast data covering statistics like revenue, industry value add, establishments, enterprises, employment and wages in the Textile Retailing industry in Germany.

More than 6,000 businesses use IBISWorld to shape local and global economies

We were able to supplement our reports with IBISWorld’s information from both a qualitative and quantitative standpoint. All of our reporting now features some level of IBISWorld integration.

IBISWorld delivers the crisp business knowledge we need to drive our business. Whether it be serving up our major clients, winning new business or educating on industry issues, IBISWorld brings real value.

IBISWorld has revolutionised business information — which has proved commercially invaluable to exporters, investors and public policy professionals in Australia and overseas.

When you’re able to speak to clients and be knowledgeable about what they do and the state that they operate in, they’re going to trust you a lot more.

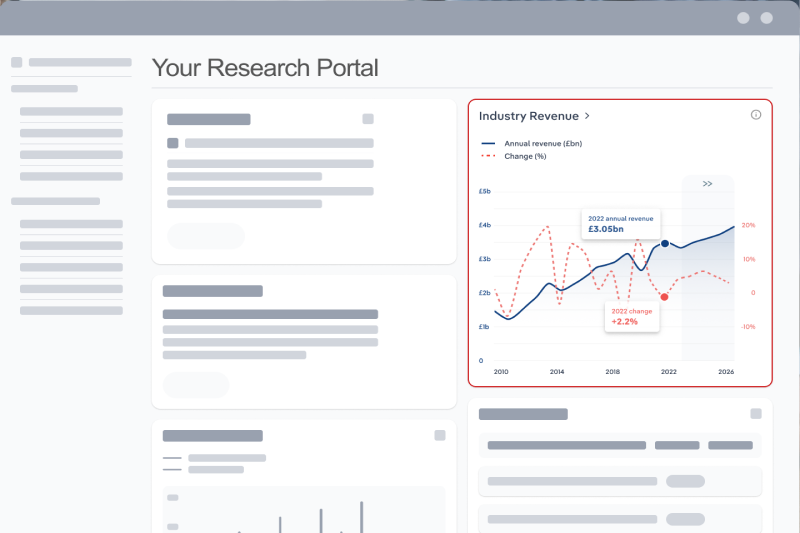

The market size of the Textile Retailing industry in Germany is €3.4bn in 2026.

There are 6,601 businesses in the Textile Retailing industry in Germany, which has grown at a CAGR of 2.7 % between 2020 and 2025.

The market size of the Textile Retailing industry in Germany has been growing at a CAGR of 3.0 % between 2020 and 2025.

Over the next five years, the Textile Retailing industry in Germany is expected to grow.

The biggest companies operating in the Textile Retailing industry in Germany are Inter Ikea Systems BV, Jysk A/S and The TJX Companies Inc

Bedroom and bathroom textiles and Large textiles are part of the Textile Retailing industry in Germany.

The company holding the most market share in the Textile Retailing industry in Germany is Inter Ikea Systems BV.

The level of competition is moderate and steady in the Textile Retailing industry in Germany.