Key Takeaways

- Early visibility into labor conditions helps reveal whether a market’s growth potential can be delivered at scale.

- Labor capacity serves as a critical input in determining whether a strategy is viable, not just ambitious.

- Industry research offers a common set of labor benchmarks that help teams align on workforce feasibility before execution begins.

A multinational manufacturer had all the signals aligned. Demand for electric components was spiking, margins looked healthy, and their board had just greenlit a major expansion into a new region. But six months in, rollout stalled. The local labor pool was too thin. Specialized technicians were scarce, wages spiked, and projects that looked scalable on paper began to drag. By the time operations caught up, competitors had already moved in.

Most strategy teams know how to spot a good market. They look for strong demand signals, attractive margins, and room to scale. But what looks promising in the boardroom can quickly begin to unravel on the ground. Not because the opportunity disappears, but because the business cannot deliver fast enough, affordably enough, or at all.

The missing filter is workforce deliverability.

While revenue potential gets modeled and stress-tested, execution capacity is often assumed. Hiring delays, wage blowouts, and skill shortages surface only after the plan is already in motion. By then, the costs are real: stalled rollouts, shrinking margins, and missed windows.

Business strategists have seen this play out repeatedly. Growth plans run up against bottlenecks that were not accounted for. Stakeholders grow frustrated. Resources get stretched. Credibility takes a hit.

The fix is not to plan smaller. It is to plan smarter. Labor data must be part of the early screening process. Metrics such as employment growth, wage intensity, and labor volatility help validate whether the business can actually scale in a target market or whether the risks outweigh the return.

Workforce should be treated as a strategic input. When ignored, it can quietly derail even the strongest growth opportunities. When factored in, it helps focus resources on markets that are not only attractive but executable.

Because a strategy that cannot be delivered at scale is not a strategy. It is a stalled ambition.

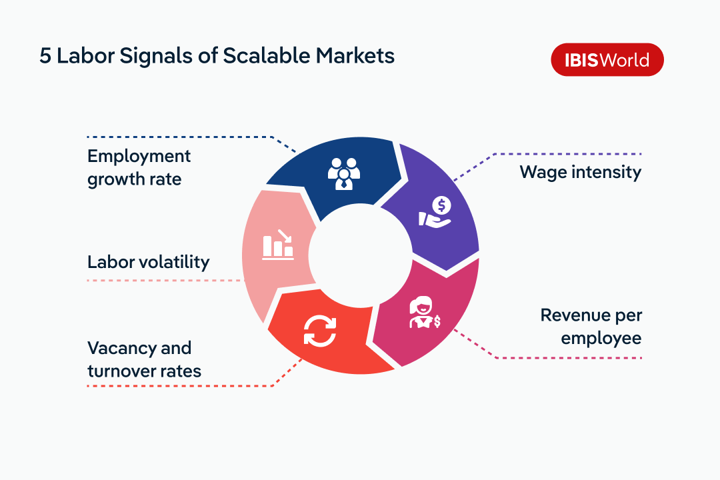

5 workforce indicators that reveal market scalability

A market may look attractive on the surface, but if the labor environment is unstable, inefficient, or costly, execution can stall before it starts. These five indicators help business strategists evaluate whether a target market is not only worth pursuing but also realistically scalable.

Each indicator plays a distinct role in revealing hidden friction. Together, they form a multidimensional view of workforce deliverability that supports more grounded, executable planning.

1. Employment growth rate

This metric signals the direction and momentum of a market’s talent pipeline. Positive employment growth suggests that businesses are hiring and that the region or industry is expanding its workforce at a sustainable pace. This often translates to greater ease in sourcing talent, building teams, and executing at speed.

A stagnant or declining employment trend is a red flag. It may reflect aging demographics, slow recovery in the labor pool, or limited interest in the roles a given industry offers. These dynamics increase hiring competition and may delay resourcing for even the best-funded initiatives. Strategists should avoid assuming that headcount will be easy to scale in flat or shrinking labor markets.

2. Wage intensity

Wage intensity is typically measured as total wages paid divided by total revenue. It reveals how much of an industry's income is absorbed by labor costs. A high ratio suggests that staffing is a major cost driver and that margins may narrow as operations expand.

By contrast, a low or declining wage intensity signals operational leverage. This is especially valuable in industries that can rely on automation, platform models, or fixed-cost infrastructure. Markets with lower wage intensity tend to scale more efficiently, giving strategy teams more room to invest, absorb shocks, or accelerate growth without immediate labor constraints.

3. Revenue per employee

Revenue per employee is a proxy for labor productivity. It reflects how much value each worker contributes on average. High figures suggest that businesses in the market have optimized workflows, streamlined delivery models, or adopted technologies that allow them to do more with less.

This indicator is especially important when assessing time to value. A market with strong revenue per employee is more likely to support lean teams and fast rollout, while low productivity environments may require larger headcounts and higher upfront investment just to meet baseline performance.

4. Vacancy and turnover rates

Vacancy rates measure how many positions are currently unfilled. High vacancy rates often point to persistent hiring challenges, either because of talent shortages, unattractive job conditions, or uncompetitive compensation.

Turnover rates capture how frequently employees leave their roles. High turnover is costly, both in direct rehiring expenses and in lost institutional knowledge. When vacancy and turnover both trend upward, it signals instability that can disrupt operations and delay milestones.

These rates are critical to understanding delivery risk. They don’t just tell you whether a workforce is available; they reveal how fragile or fluid it might be once deployed.

5. Labor volatility

Labor volatility tracks how dramatically employment levels shift over time. A stable market maintains relatively smooth employment patterns, while a volatile one sees sharp fluctuations due to economic shocks, regulatory changes, or demand swings.

Volatility introduces uncertainty into planning. It complicates hiring forecasts, training cycles, and capacity models. Even if a market is growing on average, high volatility can make that growth unreliable. Strategists should weigh volatility when comparing rollout timelines across regions or industries, especially for long-term investments that depend on labor continuity.

How to incorporate workforce feasibility into strategic planning

Identifying a high growth market is only the first step. The harder and often overlooked question is whether your business can actually scale into that market. Workforce constraints like hiring delays, labor cost spikes, or operational bottlenecks often emerge too late in the process, slowing execution and cutting into returns.

To avoid these pitfalls, strategic planning should incorporate a labor lens from the start. The following four steps help teams embed workforce feasibility into their prioritization, sequencing, and resource allocation decisions.

Step 1: Scan for labor signals alongside growth metrics

Begin with a shortlist of attractive markets based on traditional indicators like demand growth, margin potential, and addressable revenue. Then, layer in external labor metrics to surface any early signs of friction. This includes hiring difficulty, wage instability, or skill shortages, all of which can undercut execution before rollout even begins. Markets that appear promising on paper may turn into slow moving or high risk plays if labor challenges go unaccounted for. Use workforce signals as a filtering layer, not an afterthought.

Step 2: Evaluate cost efficiency and productivity benchmarks

Once initial red flags are identified, dig deeper into each market’s operating model. Analyze how labor costs align with output through indicators like wage intensity (wages as a share of revenue) and revenue per employee. These benchmarks help determine whether a market can support scalable operations or whether it will demand high touch resourcing. Industries with lean, productive models can support faster expansion with fewer operational constraints, a critical advantage in execution heavy phases of growth.

Step 3: Localize risk by region or segment

Labor friction rarely hits uniformly across a market. Use regional and sub sector data to isolate hidden vulnerabilities that national averages may obscure. Persistent vacancy rates, high turnover, contractor reliance, or wage volatility in specific regions can all signal execution drag. Mapping these risks by geography or segment allows teams to pressure test rollout plans more realistically and make smarter decisions about where, how, and when to scale.

Step 4: Re-rank opportunities and align stakeholders around feasibility

Before finalizing strategic bets, revisit your shortlist with deliverability in mind. Score each market not just on its upside, but on its ability to scale without bottlenecks. A market with strong demand but major labor constraints may be better suited for later phases, slower expansion, or targeted pilots. Just as important, bring strategy, operations, and finance teams into alignment using shared workforce benchmarks. Standardized dashboards or scorecards ensure all functions are working from the same assumptions, avoiding breakdowns between planning and execution.

Why strategy and execution drift apart and how to close the gap

Many growth strategies begin with optimism. The numbers look strong, the market is expanding, and forecasts suggest a clear runway. But somewhere between the plan and the rollout, momentum slows. Hiring lags. Costs creep. Teams fall behind schedule. What happened?

In many cases, the problem isn't the market. It's the mismatch between the assumptions built into the strategy and the realities faced by those responsible for executing it.

Planning teams often work in aggregate. They model demand, margins, and TAM. They assume capacity can scale with ambition. But execution lives in the details: in onboarding timelines, training constraints, and the limitations of current staff. When workforce feasibility is not built into the initial plan, the gaps emerge later in the form of missed targets and frustrated teams.

The friction tends to surface in three ways:

- Unshared assumptions: Strategy assumes hiring will be easy. Operations knows it won’t be.

- Asynchronous timelines: Planning cycles move fast. Talent pipelines do not.

- Misaligned metrics: Strategy talks growth. Execution talks capacity.

This isn’t a failure of judgment. It’s a failure of shared visibility.

The solution is to align teams early using a common set of external labor benchmarks. When strategy, finance, and delivery teams start with the same data on hiring friction, wage pressure, and productivity dynamics, they can agree on what’s possible and when.

Industry research plays a key role here. It adds an external layer of credibility that can resolve internal deadlocks. Rather than debating assumptions, teams can validate plans against impartial data and adjust course before resources are committed.

Closing the gap between strategy and execution does more than reduce risk. It protects timelines, preserves margins, and earns trust across functions. And it starts by treating workforce deliverability as a shared input, not a downstream issue.

How industry research validates strategy before execution begins

Every growth plan carries assumptions. Some are modeled. Others are inherited. But without external validation, even the most carefully built strategies can rest on shaky ground.

This is where industry research plays a critical role. It equips planning teams with impartial benchmarks that challenge internal narratives, surface blind spots, and ground decisions in reality. Especially in workforce-constrained environments, relying solely on internal data or anecdotal inputs can lead teams into markets they are not operationally equipped to serve.

Industry research supports feasibility in three key ways:

1. It benchmarks labor conditions across industries and regions

Rather than guessing whether a market’s hiring environment is favorable, strategists can access metrics such as employment growth, labor volatility, and wage intensity from trusted data sources. This allows quick comparison across markets and helps identify environments where execution is more likely to succeed.

For example, a manufacturing expansion may appear viable based on projected revenue. However, if labor data reveals elevated vacancy rates and declining productivity in the region, the team can reassess whether the timing or scope needs to change.

2. It quantifies risk that internal data can miss

Internal systems capture what has already happened. Industry research helps anticipate what could happen next. Forward-looking labor forecasts and sector benchmarks allow teams to spot emerging constraints before they affect performance.

This perspective is especially important when evaluating multiple markets or weighing whether to accelerate or pause rollout. Research can reveal the warning signs that internal data does not yet reflect.

3. It creates a neutral foundation for alignment across functions

Independent data reduces friction between teams. It gives the strategy team external proof points. It provides finance with credible assumptions. It helps operations assess whether timelines are realistic. This shared foundation makes it easier to align around a common view of what is achievable.

When industry research is integrated early in the planning process, it improves confidence in the strategy itself. It prevents misalignment, reduces the risk of late-stage objections, and ensures resources are directed to opportunities that are both attractive and deliverable.

Final Word

Strong strategies depend on more than vision; they depend on viability. It is no longer enough to chase growth where demand or margins look high. You must also assess whether your teams can hire, train, and deliver at scale before committing resources.

Labor benchmarks like employment growth, wage intensity, and revenue per employee reveal whether a market is operationally realistic. When paired with external research, they give a fuller picture of opportunity and constraint.

This is not just about risk avoidance; it is about moving faster and building trust. Teams that prioritize feasibility early avoid speculative moves and focus on scalable wins.

Ambition alone does not drive success. Execution does. And execution starts with workforce deliverability.

Feasibility does not limit growth. It protects it.