Key Takeaways

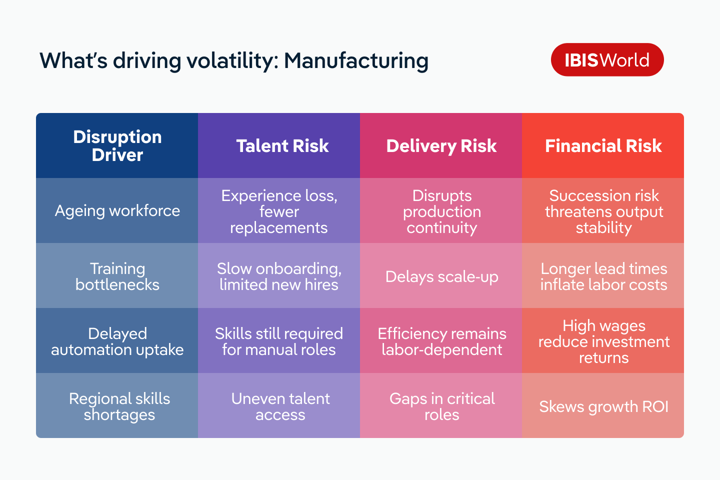

- In manufacturing, skills mismatches, ageing workforces and patchy pipelines are delaying delivery, even in regions with strong capital support.

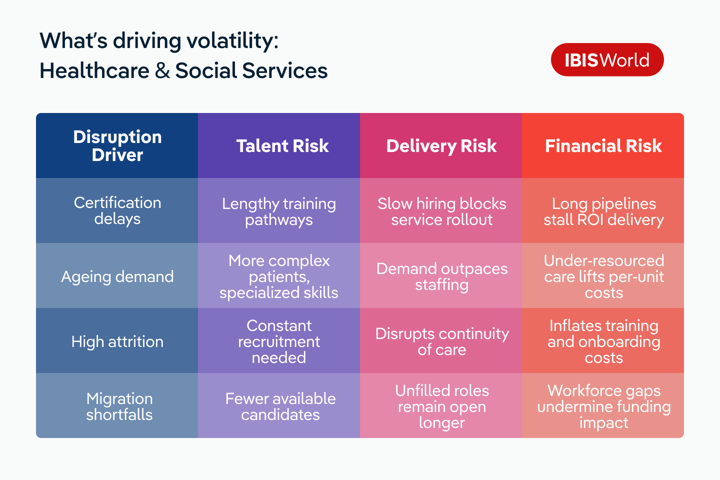

- In healthcare, structural staff shortages are limiting service expansion as training bottlenecks, turnover and credential needs slow rollout.

- In construction, project timelines and ROI are being reshaped by labor shortfalls, with staffing gaps now rivaling capital as a constraint on delivery.

In some sectors, labor shortages have become a structural barrier to delivery. In manufacturing, healthcare and construction, persistent talent shortages are distorting project ROI and reshaping strategic priorities.

These pressures are forcing leaders to rethink what’s possible in today’s economy. Can your business grow if the workforce isn’t there to deliver it?

From goods movement to essential services and infrastructure, labor is now a limiting factor in sectors where demand should be driving growth. This article unpacks where delivery is breaking down, and how decision-makers can plan smarter in a capacity-constrained economy.

Manufacturing

Manufacturing is drawing renewed focus from investors, policymakers and strategy teams alike. Supply chain resilience, clean energy goals and geopolitical shifts are pushing governments to bring production closer to home, and billions in funding are following. But while capital is growing, workforce depth isn’t. For leaders weighing their next move, talent is fast becoming the deciding factor between plans that scale and plans that stall.

Even in regions with strong policy support, labor availability is reshaping what’s realistically achievable. Employers are finding that capital alone is not enough, and delivery now depends on whether the right talent is in place to turn strategy into output.

Across Australia, the UK and other advanced economies, structural challenges are surfacing that threaten to delay delivery and distort returns:

Australia is facing a skills mismatch

- Employers are struggling to fill roles in advanced machinery, automation and production oversight. Older workers are retiring quickly, and training pipelines have not kept up. Even with targeted support like the $22.7 billion Future Made in Australia Plan, the sector’s transformation is moving faster than workforce readiness.

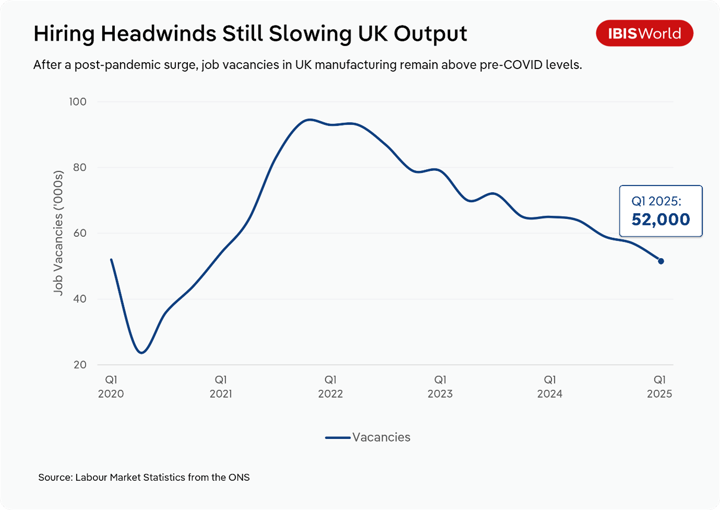

In the UK, labor supply is falling behind

- Reduced EU migration, low vocational uptake and an aging workforce are making it harder to fill critical roles. While major hubs attract more investment and training, regions with weaker pipelines are facing deeper delivery challenges.

Across Europe and North America, succession pressures are growing

- In Germany and the United States, broader labor trends are pointing to increasing strain on skilled trades. As experienced workers retire and younger cohorts pursue other paths, manufacturing and other trade-heavy sectors are finding it harder to deliver on plans as workforce gaps widen.

For decision-makers, capital is no longer the only growth constraint. Without a workforce to match the pace of transformation, even well-funded initiatives may fall short. Future planning must weigh labor availability as heavily as capital outlay and technology readiness.

Turning plans into outcomes

Capital investment alone won’t shift the dial if there aren’t skilled hands to carry it. In manufacturing, where transformation relies on both machinery and people, labor availability now defines what's achievable. These strategies help keep growth plans grounded in workforce reality and avoid stalling high-stakes initiatives.

Pressure-test growth targets against workforce availability

Capital doesn’t automatically convert to output when skills are in short supply. Review planned expansions or production increases through a labor lens. Prioritize initiatives in locations or sub-sectors with stronger talent pipelines to avoid underperformance.

Build succession planning into continuity risk assessments

When experienced workers leave, they take more than headcount; they take deep operational knowledge. Identify roles with high retirement risk and invest in mentoring, documentation and early recruitment to minimize disruptions and maintain standards.

Be pragmatic about automation timelines

Automation can reduce workforce strain, but rollout takes time. Assess which functions are automation-ready and where gradual integration will deliver stronger returns than sweeping overhauls. Focus on easing friction without introducing new complexity.

Map your footprint against regional labor realities

Workforce supply varies by region. Some areas face chronic shortages while others benefit from strong TAFE or apprenticeship pipelines. Use regional insights to guide capital planning, relocate risk, or identify where local partnerships could strengthen delivery capacity.

Healthcare and social services

From the factory floor to the front line, labor is becoming the key limiter on delivery. As we move from goods movement to essential services, the same challenge remains: systems are funded, demand is high, but the workforce needed to deliver isn’t materializing.

Across Australia, Germany and the UK, structural labor shortages are forcing difficult trade-offs. Even well-funded care systems are hitting capacity ceilings, not because of infrastructure or investment shortfalls, but because the pipeline of trained, credentialled staff can’t keep up.

Australia is facing a looming care workforce shortfall

- A shortfall of around 100,000 care workers is expected by 2027–28. Many roles require long training pathways and formal accreditation, making it difficult to scale quickly. Constraints are already limiting service delivery and putting pressure on system capacity.

Germany’s hospitals and aged care providers are hitting capacity limits

- An estimated 50,000 nursing staff are missing from the workforce. High attrition among frontline staff is compounding the issue, with many providers citing labor as their top operational constraint.

In the UK, high turnover is compounding vacancy pressures

- Adult social care continues to face high vacancy rates. Despite rising demand, employers are struggling to retain staff or attract new candidates fast enough to meet needs.

In the US, regulation is slowing AI adoption

- While AI has shown promise in diagnostics, healthcare adoption has been cautious due to strict oversight. In a high-trust, high-risk environment, technology is not replacing human labor—nor is it easing shortages.

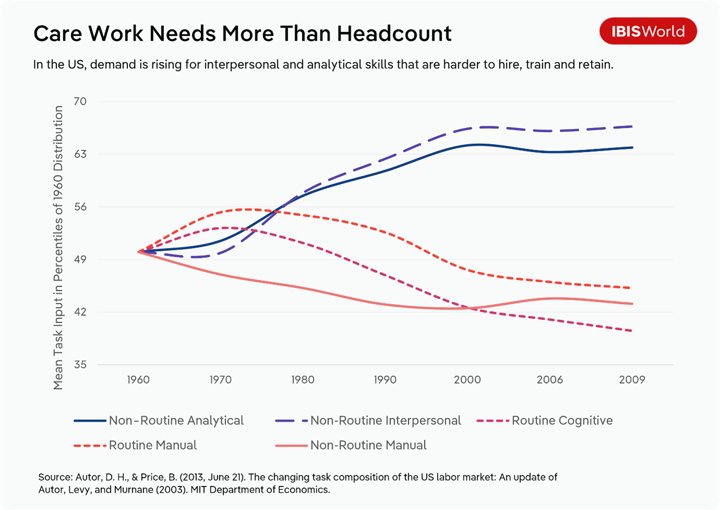

As patient complexity increases, interpersonal judgement, communication and analytical reasoning are becoming essential. These are hard to recruit for, slow to train and not easily replaced through overtime or wage increases.

For leaders in both public and private sectors, this raises the stakes. Even when funding is secured, the absence of a stable, skilled workforce risks stalling delivery. And unlike physical assets, people can’t be fast-tracked. In care, as in manufacturing, labor now defines how far policy, investment and demand can take you.

Turning plans into outcomes

Funding might open doors, but only skilled staff can walk through them. In healthcare and social services, slow training pipelines, credential requirements and high turnover make workforce planning essential. These strategies help bridge the gap between rising care needs and real-world service delivery.

Stress test capacity before expanding services

A well-funded initiative can still fail if there isn’t labor available to carry it. Before backing service expansion, scrutinize staffing capacity just as closely as financials. Forecasts should include workforce availability by region and role to avoid overcommitting and underdelivering—especially in care sectors with long training pipelines.

Partner with training providers early

Labor gaps aren’t solved in the final stretch. For sectors like healthcare, where credentialling delays are common, build relationships with TAFEs, universities and placement providers during the planning phase. This can create a reliable talent funnel and speed up service rollout—particularly valuable when pitching to boards or investors with tight timelines.

Be realistic about the limits of tech-driven relief

AI can enhance diagnostics or admin tasks, but in healthcare, regulation and trust requirements slow adoption. Don’t count on technology to fill labor gaps too quickly. Where human judgement and licensing are essential, workforce planning (not automation) is still the cornerstone of delivery.

Invest in retention, not just recruitment

In healthcare, high turnover carries both cost and compliance risk. Instead of relying on a constant stream of new hires, assess where your clients (or departments) can reduce attrition. Strategies that improve tenure—like role clarity, safer conditions or workload balance—can preserve continuity, protect patient outcomes and reduce training costs over time.

Construction

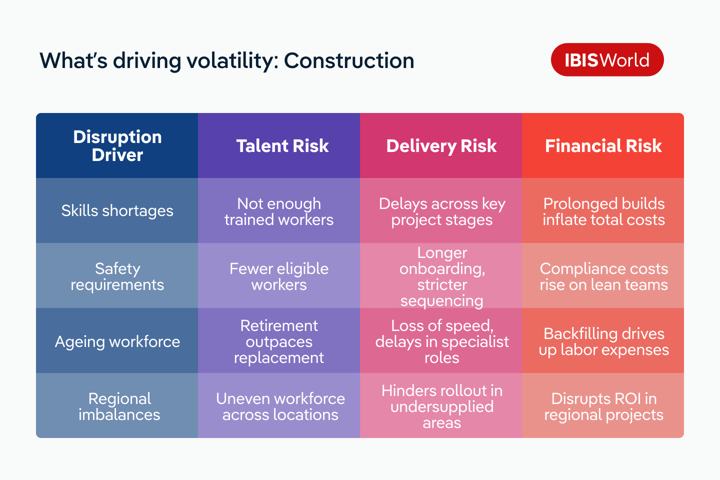

We’ve moved from goods to services to infrastructure: the final link in the growth chain. But even here, progress is stalling, not for lack of demand or funding, but because the skilled hands needed to bring plans to life are missing.

Across Australia, the UK, Germany and the US, skilled labor shortfalls are beginning to reshape how projects are prioritized and delivered. Staffing gaps are inflating costs, pushing out timelines and placing pressure on firms exposed to long-duration builds or labor-intensive phases.

Australia’s construction pipeline is under strain

- As of February 2025, there are 18,500 construction vacancies (its lowest level since 2020) but completions and commencements are still declining. Apprenticeship completions dropped down to 1.3% and trainee commencements by 6.0% over the year to September 2024, signaling continued weakness in training pipelines. Additionally, over 25% of the workforce is aged over 55.

The UK faces structural replacement risk

- In early 2025, 16% of construction firms reported shortages, the second-highest of any industry. Vacancies hit 39,000 in the March quarter alone. But with 100,000 fewer workers than five years ago and an average workforce age above 50 (similar to Australia) retirement is outpacing replacement. Apprenticeship dropout rates remain high at 40%, compounding the problem.

Germany’s project delivery is being slowed by skills gaps

- Skilled trades are among the hardest-hit occupations. An ageing workforce, low uptake of vocational pathways and education-system mismatches are all driving delays, even when capital is available.

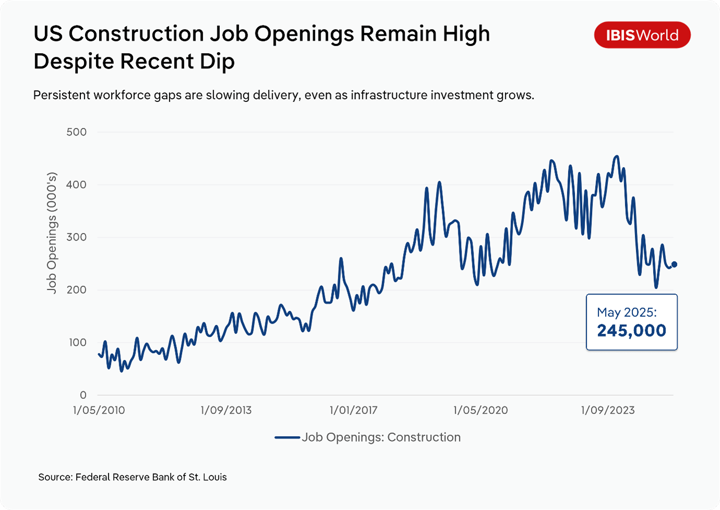

In the US, project delays are increasingly tied to workforce constraints, not funding

- Infrastructure investment is accelerating, especially in energy and technical systems. But nearly 454,000 additional construction workers are needed in 2025 alone. Delivery is now being shaped as much by labor availability as by investment scale.

For leaders planning the next phase of infrastructure investment, this marks a critical shift. Without a skilled and stable workforce, even the most well-funded projects risk delay or under delivery. Capacity—not just capital—now defines what gets built.

Turning plans into outcomes

In construction, labor is the bottleneck that materials and money can’t solve. As project pipelines grow, workforce readiness has become a make-or-break factor for timelines and ROI. These strategies help align sequencing, budgeting and delivery models with staffing realities on the ground.

Factor workforce access into project phasing

Rolling out labor-intensive phases before the right talent is in place can stretch budgets and delay results. Build labor availability into your sequencing logic to avoid idle time, compliance gaps or pressure on safety-critical stages.

Build labor constraints into project ROI modelling

Capital investment doesn’t guarantee delivery. Where shortages persist, timelines stretch and overheads rise. Model workforce volatility into your return forecasts, especially for long-duration builds, to set more realistic expectations and protect margin.

Scrutinize certification and compliance requirements

Not all skilled trades are interchangeable. Safety protocols, licensing and regulation can significantly narrow the viable labor pool. Map out where credential bottlenecks could appear, and account for them early in cost and delivery models.

Reassess regional exposure

Workforce readiness varies by region. Compare vocational training pipelines, visa settings and demographic trends to identify where your projects are most likely to stay on track. Diversifying your footprint could help offset labor risk across your pipeline.

Final Word

From goods movement, to essential services, to the infrastructure that enables both—labor has become a structural constraint on delivery, not just a staffing issue.

This shift demands a reset in how markets are sized, how projects are costed and how timelines are managed. Workforce capacity is now a gating factor for growth, and even well-funded initiatives are falling short due to talent gaps.

For decision-makers, it means balancing ambition with what's deliverable. Planning for growth is no longer just about financial capital—it’s about operational feasibility. Factoring labor risk into strategy can help prevent overpromising, protect margins and prioritize opportunities that can actually be delivered.