Key Takeaways

- Oligopolies are dominated by a small number of suppliers.

- Market power held by dominant firms is seen as anti-competitive and disadvantageous for consumers.

- It is important to be able to identify and understand the characteristics of an oligopoly, in order to gauge the motivations and decisions of oligopolistic firms.

Oligopolies occur when a small number of sellers, producers or service providers exert significant control over prices and output. As with a monopoly, oligopolies are characterised by high barriers to entry and exhibit imperfect competition; however, unlike a monopoly, firms operating in an oligopolistic market are unable to operate independently of each other. Before we break down some real-world examples of oligopolies, let’s take a look at the basics.

What are the main characteristics of an oligopoly?

Interdependence of firms

Interdependence between a small number of dominant firms is a key characteristic of oligopolistic competition. In order to protect market share, firms must consider the likely reaction of competitors when making a decision. This includes decisions on price, output and marketing strategy, with economic theory implying that firms will act in their own self-interest to settle on a sub-optimal equilibrium outcome.

A useful tool for analysing scenarios in which two agents make decisions that are interdependent is a game theory principle called the Prisoner’s Dilemma.

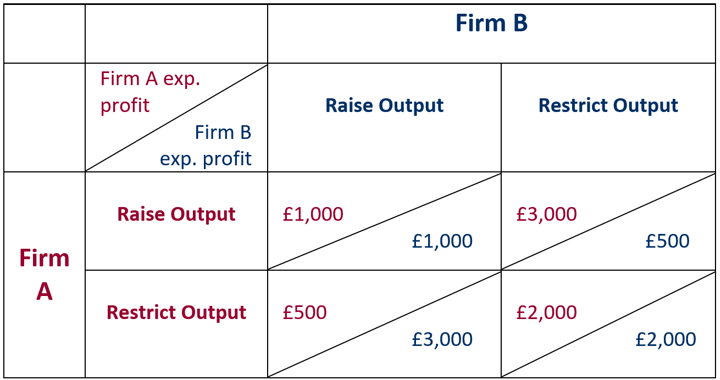

Illustrated below, firm A and firm B must decide whether to raise or restrict output as they seek to maximise profit.

- If firm A and firm B both raise output, each of them will achieve £1,000 profit.

- If firm A raises output and firm B restricts output, firm A will achieve £3,000 profit and firm B will achieve £500 profit.

- If firm B raises output and firm A restricts output, firm B will achieve £3,000 profit and firm A will achieve £500 profit.

- If firm A and firm B both restrict output, each of them will achieve £2,000 profit.

If both firms know the equilibrium strategies of the other firm, the dominant strategy for both firms, regardless of the actions of the other firm, is to raise output. As a result, path 1 is the optimal solution, or the Nash equilibrium, with each firm achieving profit of £1,000.

The Prisoner’s Dilemma also highlights the potential benefits associated with collusion in an oligopoly. If the two firms cooperate to restrict output, they will each achieve a profit of £2,000, more than the Nash equilibrium achieved in the absence of collusion.

In order to protect consumers, the Competition Act 1998 prohibits agreements between two or more businesses which have the effect of preventing, restricting or distorting competition within the UK; the Competition and Markets Authority (CMA) is the non-ministerial department tasked with promoting competition for the benefit of consumers.

Price stability

Firms in an oligopoly are prices setters. However, once these prices are settled on, they are fairly resistant to changes in costs and market conditions. Firms operate with a downward sloping demand curve, meaning that as prices fall, demand rises. The price elasticity of demand differs depending on the likely reaction of other firms to price changes, further demonstrating the interdependence between firms in an oligopoly.

Theory suggests that firms operating in an oligopoly have little incentive to drastically change their prices.

It is assumed that rival firms will not follow price increases by an individual firm, causing the firm raising prices to lose market share and revenue. In contrast, rival firms will match price reductions, limiting any potential increase in demand and causing revenue to fall.

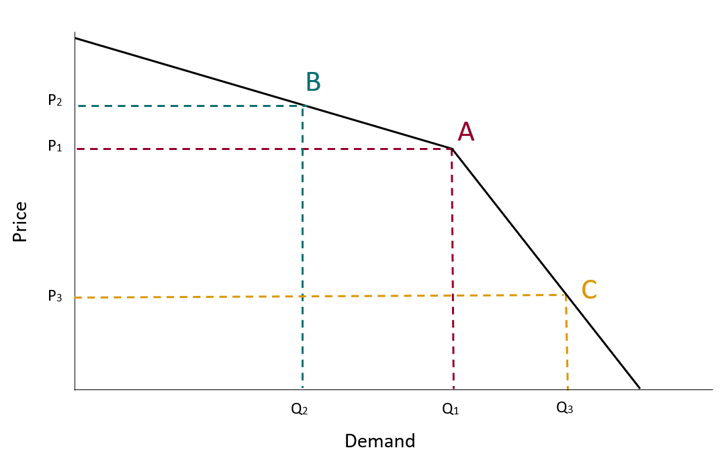

This theory is best illustrated using a kinked demand curve, which shows that there is a kink in the demand curve above the prevailing price (P1). The segment above P1 is more elastic, while the segment below P1 is more inelastic. Revenue is represented by the area underneath the equilibrium price and quantity.

- Effect of a price increase: If a firm raises its price from P1 to P2, the equilibrium moves from point A to point B, leading to a fall in demand from Q1 to Q2 and a subsequent fall in revenue. This is due to competitors maintaining their price at P1, leading to a loss of competitiveness.

- Effect of a price reduction: If a firm lowers its price from P1 to P3, the equilibrium moves from A to C, leading to a slight rise in demand from Q1 to Q3 but a fall in revenue. This is due to rival firms following the price reduction, limiting the scope for the firm to increase market share by lowering prices.

Non-price competition

In order to avoid a price war, non-price competition is key for firms to gain an advantage over rivals. Non-price competition makes competitive intelligence crucial for firms to understand their rivals.

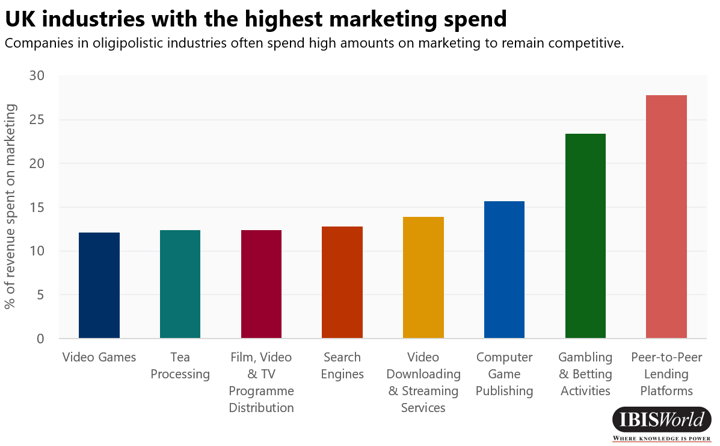

Firms invest heavily in advertising, branding and marketing campaigns to distinguish themselves from competitors.

Customer loyalty and quality of service are also key points of differentiation.

The above graph displays the UK industries whose marketing costs are highest. The Computer Game Publishing, Video Downloading and Streaming Services and Video Games industries are all considered to be oligopolies, demonstrating the importance of non-price competition to firms operating in an oligopoly.

Oligopoly examples

Using IBISWorld reports, potential oligopolies can be easily identified by examining the following traits:

- Market Share Concentration: A four-firm concentration ratio exceeding 40% indicates oligopolistic competition.

- Barriers to Entry: High barriers to entry enable firms to maintain significant control over the industry.

- Basis of Competition: Oligopolies are characterised by a high degree of non-price competition.

- Cost Structure Benchmarks: Firms in an oligopoly typically dedicate a significant share of revenue to marketing spend.

Below are some examples of oligopolies from IBISWorld’s collection of industry reports:

Supermarkets in the UK

Supermarkets in the UK is a clear example of an oligopoly. The industry is dominated by a small number of large firms, with the top four players – Tesco, Sainsbury’s, Asda and Morrisons – expected to account for 54.4% of industry revenue in 2022-23. Reversing a long-term upwards trend, the industry’s market share concentration has come under threat from the emergence of low-cost supermarkets such as Aldi and Lidl over the past decade. Nevertheless, barriers to entry are high, most notably in the form of capital requirements.

A key oligopolistic trait displayed by supermarkets is strategic interdependence between firms. Price stickiness means that non-price competition is the key form of differentiation. This has spurred innovation within the industry, with Just Walk Out technology in the early stages of adoption among the top four players.

The expected response of rivals is a key consideration for supermarkets when making investment decisions. The firm that moves first shoulders the burden of risk associated with the investment in return for a potential head-start on revenue, while other firms are able to observe the success of the strategy before deciding whether to launch it themselves.

Although supermarkets are reluctant to change prices due to the adverse effects on revenue, they have been forced to lower prices in recent years, with price wars breaking out between the big four firms and low-cost competitors.

Most recently, Asda and Morrisons have attempted to undercut each other on the price of everyday items. Meanwhile, Tesco and Sainsburys have each committed to price matching low-cost competitor Aldi on hundreds of popular items. Such activity is exemplary of oligopolistic competition, with price reductions constraining revenue over the past five years.

Banks in the UK

High-street banks are dominated by a handful of household names, with the industry displaying key characteristics of an oligopoly. According to figures from UK Finance, in 2020, the UK's six largest lenders – Lloyds Banking Group, building society Nationwide, NatWest Group, Santander UK, Barclays and HSBC – accounted for 71.2% of total gross lending.

Following the financial crisis, the Financial Conduct Authority has tightened regulation within the banking sector, with stress-testing introduced in 2014-15 to determine the ability of a bank to cope during adverse economic conditions. Such regulation has increased barriers to entering the industry, helping to maintain the dominance of the largest lenders.

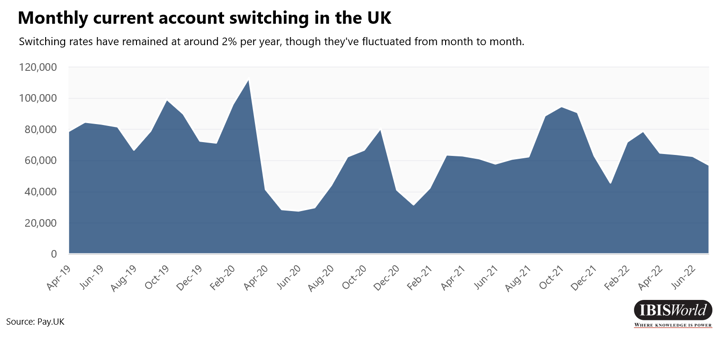

This dominance has spurred several investigations by the CMA in recent years, leading to efforts to reduce concentration and promote competition, including the launch of a seven-day switching service in 2013.

However, switching rates have continued to hover around 2% per year since the introduction of the guarantee. Although digital challenger banks, such as Revolut and Starling, have made some inroads into the market, similar products and incentives offered by major banks maintains significant barriers to success for smaller operators.

Soft Drink Production in the UK

The Soft Drink Production industry forms part of a global battle between two universally recognisable brands: Coca-Cola and Pepsi. These brands are present in the United Kingdom through respective manufacturing licences held by Coca Cola Europacific Partners Great Britain and Britvic. The dominance of these firms contributes to a top four firm concentration ratio of 56.4% in 2022-23.

Barriers to entry are low compared with other oligopolistic industries, with changing consumer tastes presenting opportunities for new firms to enter the market. However, barriers to success are high, with the economies of scale held by larger incumbent firms preventing smaller rivals from competing for market share.

There is significant interdependence between the largest brands, particularly Coca-Cola and Pepsi, with the benefits associated with price changes likely to be nullified by the reaction of the rival firm.

Since price changes often prove a blunt tool to maximise profit, the industry is characterised by a high degree of non-price competition. Coca-Cola and Pepsi are gripped in one of the most infamous marketing battles in history, with neither brand likely to let its rival embark on a major marketing campaign without undertaking a similar action in response. The rivalry has become so intense that it has been labelled ‘cola wars’, with aggressive marketing strategies adopted including comparative advertisements, product placement and major sponsorship deals.

Oligopoly pros and cons

As the examples above depict, oligopolistic competition is present in several major industries and has a considerable impact on UK consumers. As a result, the theory that excessive concentration between a small number of price-setting firms leads to above-normal profit is a significant concern for policy-makers. Reviews of industries, including the Big Four oligopoly in auditing, generally result in greater government oversight.

Energy supply case study

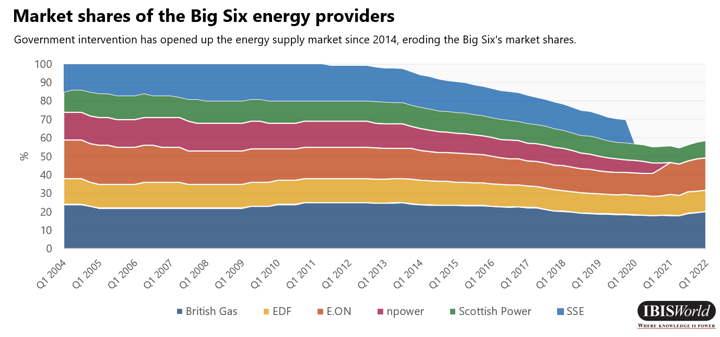

Perhaps the most high-profile recent example of government intervention is in the gas and electricity supplier market, in which Ofgem effectively brought the long-standing dominance of six large suppliers to an end. By encouraging consumers to switch electricity supplier in search of a better deal, Ofgem stimulated the entry of independent energy brands, eroding the dominance of the Big Six from 92% in 2014 to 70% in 2019. The sale of SSE's domestic customer book to OVO Energy in January 2020 effectively bought to an end the oligopolistic power of the Big Six.

With the help of the introduction of the energy price cap, this led to more competitive energy prices for consumers. However, the current energy crisis has highlighted significant weaknesses in Ofgem’s approach to reducing excessive concentration in the market, with several independent energy suppliers unable to cope with volatile wholesale prices. This has led to millions of customers being transferred back to the largest suppliers, threatening to reinstate the market power previously held by these firms. This is exemplary of the difficulties associated with breaking up oligopolies.

In contrast, the Supermarkets industry proves that prices can be competitive in an oligopoly without the need for significant government intervention. That being said, the incentive for firms to collude in search of higher profit is likely to prevail in the absence of government oversight.

It’s also important to ensure that consolidation activity between firms in an oligopoly doesn’t lead to further lessening of competition, a concern that caused the CMA to block a proposed merger between Sainsbury’s and Asda in 2019.

Final Word

Overall, the formation of an oligopoly is always likely to benefit the seller or producer at the expense of the final consumer.

Although non-price competition is a key factor in oligopolies, innovation is limited to the research and development activities of a small number of firms, with high barriers to entry preventing the introduction of new ideas into the market. In addition to a lack of price competition, this constitutes one of the main arguments towards government intervention when it comes to oligopolistic competition.