Even as inflation continued its upward trend this quarter, the economy showed resilience, with real GDP increasing at a CAGR of 2.3%. The expanding labor market contributed to job growth, keeping unemployment rates in check, despite some major sectors slowing their hiring due to concerns about the sustainability of ongoing expansions. Consumer spending sustained the economy, focusing on sectors offering immediate value. In the residential construction sector, increased market valuations and vigorous homebuying activities spurred growth. Financial markets also experienced a rally this quarter, influenced by an election outcome that kept the economy on alert, coupled with interest rate cuts, signaling a return to business as usual. But nonresidential construction activity decelerated as investors exercised caution, adopting a wait-and-see approach to assess long-term economic feasibility.

Labor market

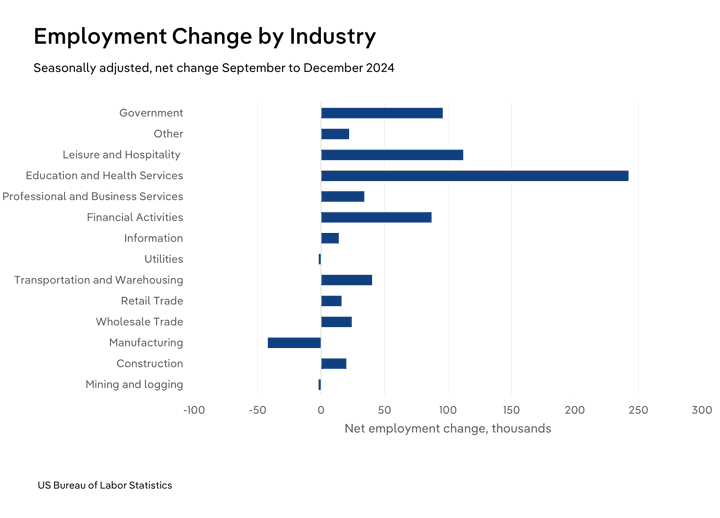

- The labor market remains strong despite concerns about shortages in certain positions, like drivers. In the fourth quarter of 2024, employment increased 0.4%, or about 612,000 jobs, from the previous quarter. This growth was driven by interest rate cuts, stable spending habits and industries with strong performances expanding their workforces in response to this slightly improved economic outlook.

- Industries like financial activities, education and health services primarily drove job growth in the most recent quarter. Burgeoning financial optimism after the election and the need for skilled workers in technical and knowledge-based roles, such as analysts and accountants, boosted the financial sector. In addition, the education and health services sectors saw growth from strong consumer spending on healthcare and robust student enrollments, leading to accelerating staffing needs.

- Unemployment rose above 4.0% in the fourth quarter of 2024, driven by manufacturing, mining and logging job losses. High costs and a focus on efficiency have reduced the need for workers as automation increasingly replaces jobs, and as financial pressures encourage companies to pause hiring.

- In January 2025, average hourly earnings rose to approximately $35.87, a 4.1% jump compared to January 2024. Employers are raising pay because of various factors, including the need for more skilled workers, adjustments for the rising cost of living and labor unions’ impact on wage negotiations.

Consumer spending

- In the fourth quarter of 2024, consumer spending expanded by 1.6% compared to the third quarter. Despite the rising costs, consumers continued to spend on goods and services, focusing more on services that offer immediate value instead of long-term investments.

- During the quarter, transportation and recreation experienced bolstered spending. The transportation sector, in particular, saw significant growth as consumers booked more trips, leading to higher spending on airline services. Airlines capitalized on this trend by imposing additional fees, such as charges for baggage handling, boosting consumer spending.

- In this sector, recreation has greatly benefitted from large live events and shows that have drawn significant consumer spending. Sporting events have especially surged in the quarter as major sports like football and college gear up for their seasons. Because of the high needs of this expanding market, these organizations have been able to boost their ticket prices.

- Health spending experienced slow growth in the fourth quarter of 2024, inching upward by just 1.5% from the previous quarter. While people continue to spend on healthcare services, the rate has declined from last quarter. The preference for outpatient care, which tends to be less expensive than inpatient services, contributes to this slowdown. As consumers increasingly choose shorter hospital stays or outpatient services to avoid high costs, spending growth in the health sector has decelerated.

Inflation

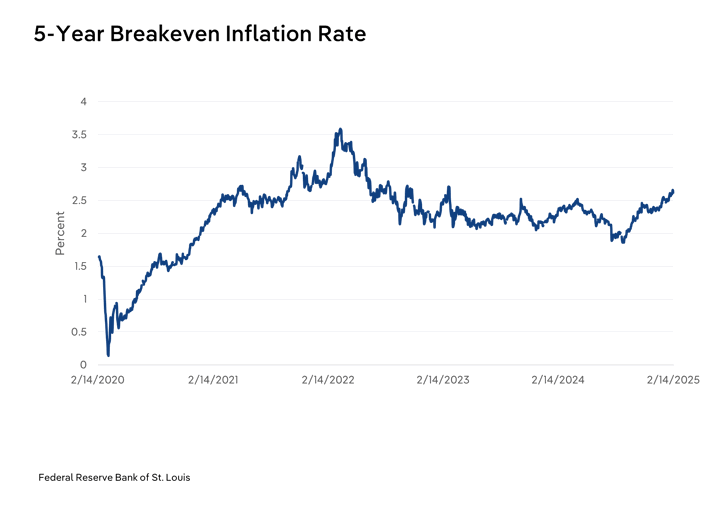

- Inflation persisted, rising by 0.5% in Q4 compared to Q3. These inflated costs pushed the year-over-year Consumer Price Index (CPI) to 2.7% in Q4 2024, exceeding the Federal Reserve’s target of 2.0% for potential interest rate cuts. These numbers indicate that inflation continues to drive up costs. Since September 2024, monthly year-over-year prices have been increasing, reaching 2.9% in December 2024, according to the Bureau of Labor Statistics.

- In the fourth quarter of 2024, prices for items like eggs and airline fares surged, with eggs rising by 9.0% and airline fares by 8.0% compared to the previous quarter. The ongoing bird flu epidemic severely reduced poultry populations, limiting egg production and hiking prices. Meanwhile, the surging number of passengers has pressured airline services, raising costs and leading to higher fares to cover these expenses.

- Both gasoline and smartphone prices have plummeted this quarter, dropping by 9.0% and 7.0%, respectively. The drop in gasoline prices can be attributed to increased domestic energy production in the US, which has consistently lowered energy costs throughout the year. As for smartphones, decisions to discount underperforming models have reduced prices, with consumers shifting their spending toward other types of technology, thereby diminishing the smartphone sector’s influence.

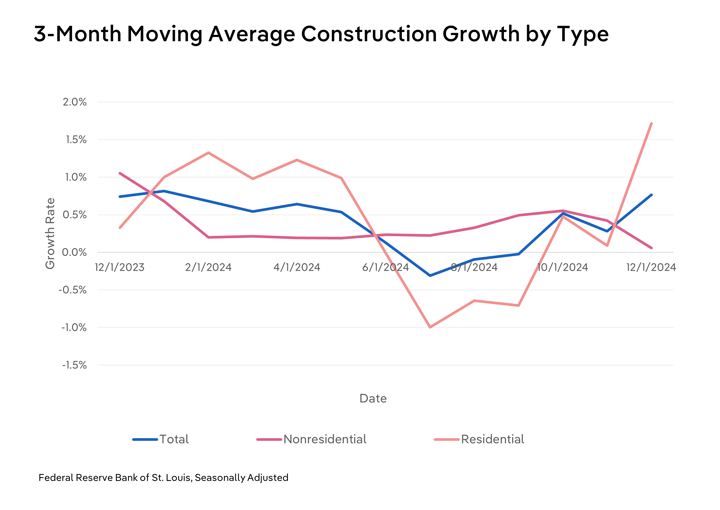

Residential construction

- Residential construction spending climbed 1.7% between the third and fourth quarters of 2024. This growth was driven by a tight housing market with restricted supply and low housing stock, making these construction projects valuable. Developers see this as an opportunity to create added value during significant volatility in the construction industry.

- Despite a drop in interest rates, mortgage rates have remained high, reaching 6.7% in December, up from 6.2% in September. These rates are linked to 10-year Treasury notes, and persistent inflation has signaled to investors that the economy remains risky. Because of this, higher yields have been necessary, leading to swelling mortgage rates to ensure they were an attractive option for investors seeking stable, safe returns.

- Rising mortgage rates have driven up the cost of homes, with prices reaching $510,300 in the fourth quarter. These prices slightly rose from the third quarter at $498,700. The heightened valuations of residential properties come at a time when construction costs have soared, making it more difficult for prospective buyers to find affordable housing options.

- With increased mortgage rates, the average cost of homes rose to $510,300 in the fourth quarter, up slightly from $498,700 in the third quarter. This gain reflects the rising valuations of residential properties during a time when construction costs are high, making it difficult for buyers to find affordable housing options.

- Despite rising housing costs, home sales have been robust, particularly in December, with the highest sales since February 2024. Dropped prices have attracted both first-time and repeat buyers seeking affordable options. Simultaneously, newly listed homes have drawn interest from wealthier buyers and investors because of their future market potential, given the tight housing market. This trend has been especially notable in the Southeast, where economic activity boosts property value and appeals to buyers.

Nonresidential construction

- In the fourth quarter of 2024, nonresidential construction spending inched up only 0.1% compared to the third quarter. This sluggish growth is because of lingering inflation and uncertainty about whether to proceed with projects now or wait until the economy fully recovers.

- In the fourth quarter of 2024, spending on commercial buildings contracted 0.3%. This drop primarily results from companies postponing construction until they secure adequate funding, particularly for future projects like data centers. These companies and cautious investors hesitate to invest because of the high costs. Investors are adopting a wait-and-see approach, holding back their investments as they assess the economic climate and market activity for building expansions.

- Despite accelerating vacancy rates, office construction expanded from the third to the fourth quarter of 2024. This expansion was driven by renovating and remodeling facilities to accommodate reconfigured workforce sizes. Companies are also beginning to strengthen investments in future locations with market value, seeking cost-efficient areas with steady economic activity. This trend has fueled office construction projects, particularly in regions like the South.

Financial

- After the election, the Federal Reserve reduced rates by quarter points in November and December. Improving inflation figures and stable unemployment levels influenced their decision to do so in hopes it would revitalize the economy gradually.

- The stock market performed well, with the S&P 500 gaining 2.1%, driven by the “Magnificent 7” stocks. The NASDAQ and Dow Jones also experienced positive gains. This year has been positive for sectors such as communications, financials and information technology, as these areas have become increasingly valuable. The introduction of AI models, which boost efficiency and are essential for knowledge-based sectors, has contributed to the growing importance of these industries.

- Asset classes performed well this quarter, with large-cap stocks and Bitcoin leading. Investors are increasingly drawn to these safer investments because of their potential growth. Major companies within these indexes are actively engaging with promising trends like AI. Post-election clarity also has positively impacted the cryptocurrency market, as the Trump administration’s commitment to a deregulated environment generated optimistic expectations.

Risk ratings

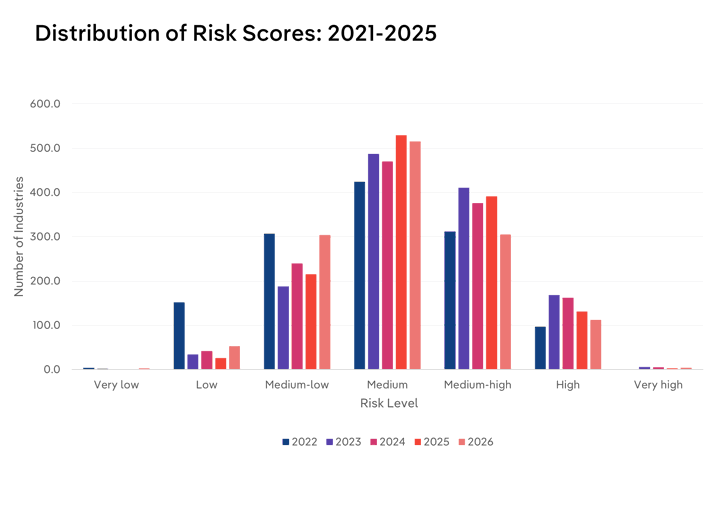

- Inflation and supply chain issues continued to be a problem in 2022. As such, 31.6% of industries were rated as medium-high or under greater risk as the world began to respond to such pressures on the economy.

- As inflation remained an issue, interest rates scaled up in 2023. This led to nearly 45.1% of industries being rated as medium-high or even higher during the year as markets struggled to respond to such factors.

- In 2024, inflation and interest rates contracted, with the latter starting to drop back in September. This reduction slightly lowered costs for businesses and consumers. But despite these cuts, YOY price growth was at 2.9%, slightly above the Federal Reserve’s target rate of 2.0%, moderating these rate cuts. This enabled only a slight dip to 41.9% of industries classified as having a medium-high or higher risk throughout the year.

- In 2025, interest rates will begin to drop, but the Federal Reserve has made it clear that it will do so at a slow pace to bring stability to the economy. The Trump administration’s deregulation efforts through executive actions will potentially help parts of the economy, such as cryptocurrency and AI infrastructure development, though these orders can be swiftly blocked or overturned. While markets will likely stabilize, they may also contend with tariff-related issues. The administration’s proposed tariffs in 2025 introduce the risk of cost volatility, especially for industries dependent on imports, resulting in 40.5% of sectors classified as facing medium-high or greater risk.

Sector rankings

- Agriculture, Forestry, Fishing and Hunting - The sector has been grappling with intensifying risks because of uncontrollable epidemics such as the bird flu, which has threatened chicken populations with no effective cure currently available. This situation has heightened the risks associated with egg production in the US, turning what is typically a strong staple into a costly commodity. Because of this evolving matter, industry stakeholders are closely watching to see whether prices will stabilize or recover this year. Also, this issue endangers the poultry meat sector, as chicken meat could face more considerable challenges if the situation deteriorates, especially in the absence of viable import alternatives for the US. Sectors such as Chicken & Turkey Meat Production and Chicken Egg Production will be at risk.

- Construction - In 2025, several projects aimed at developing markets, like data centers and AI infrastructure, are set to drive a surge in the construction industry. This surge will create a high need for electricians to install power lines in these facilities. At the same time, the residential housing sector will expand in response to persistent issues of low housing stock and high housing costs. Developers will have to act quickly to address this market activity, hoping to take advantage of the boom in housing needs before supply levels stabilize. This environment will benefit sectors such as Home Builders and Electricians significantly.

- Real Estate and Rental and Leasing - Newly constructed facilities will require real estate agents and leasing experts to market and sell these properties to potential clients effectively. Even in areas with strong market activity, these properties will face competition, highlighting the need for experts who can secure maximum value. Also, individuals who are financially unable to purchase homes will bolster the rental market, sustaining its growth. These dynamics will drive the Apartment Rental and Real Estate Sales & Brokerage sectors.