The economy expanded in Q2 2025, driven by steady consumer spending and a drop in import volumes linked to ongoing tariff issues. Hiring rose in some sectors like leisure and hospitality, but these gains were moderated by layoffs and uncertainty elsewhere, with many sectors hesitant to expand during the period. Construction investment fell over the quarter. Both residential and nonresidential activity showed weaker growth overall, although investment in data centers and multifamily housing increased. Financial markets rallied, with investors favoring technology and Bitcoin as a wave of AI products entered the market, creating expectations of future opportunities. Inflation rose because of production issues in domestic industries, pushing costs higher and leading the Federal Reserve to keep interest rates unchanged because inflation remained above the 2.0% target. Real GDP grew at an annualized rate of 3.0% in Q2 2025.

Labor

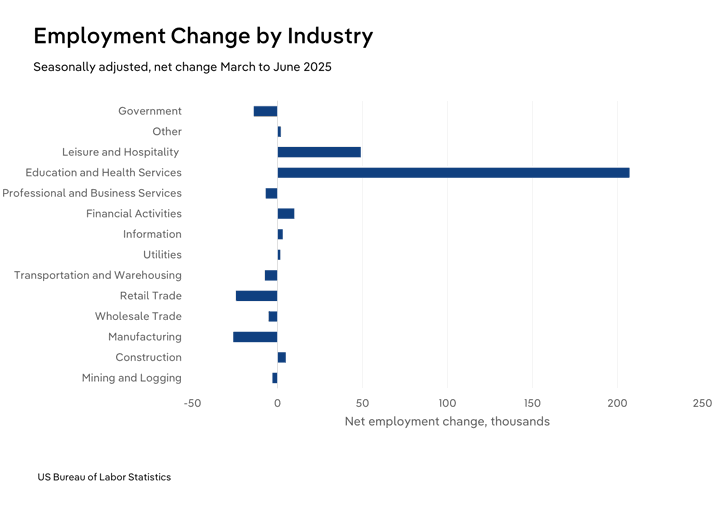

- Despite ongoing pressures, the labor market grew, adding 191,000 nonfarm jobs in Q2 2025, a 0.1% gain from Q1 2025. Growth has been slowing as operational costs expand. Tariffs, worries about AI displacement and broader factors like inflation and interest rates have pushed employers to prioritize efficiency over expansion, resulting in targeted hiring rather than broad-based gains.

- Education and healthcare led job growth, reflecting their roles as providers of essential services. An aging population moving into retirement and needing more support has increased the need for specialized workers in these fields.

- The unemployment rate was 4.1% in June, slightly decreasing from 4.2% in May and April. The slight improvement was largely because fewer people quit their jobs. At the same time, layoffs and discharges increased in mining, logging and information sectors. These cuts were tied to production challenges, cyclical adjustments and changes in white-collar roles associated with AI. Together, these factors prevented a stronger improvement in unemployment.

- Wages continued to boost, increasing 5.4% year over year in June 2025. Information, professional and business services led wage growth because of strong demand for skilled workers. In addition, union membership impacts and higher minimum wages contributed to rising compensation across many industries over the quarter.

Spending

- Consumer spending rose 2.4% in the quarter. Households kept spending even with mixed views on tariffs, supported by ongoing wage gains and steady disposable incomes. For now, these tailwinds have helped keep day-to-day spending patterns relatively stable.

- Durable goods spending rose 5.2% in the quarter. The lift came mainly from automobiles, especially light-duty trucks, as buyers responded to improved pricing. Automakers helped by absorbing some cost pressures and using targeted incentives to keep monthly payments attractive, even though these moves weighed on profit.

- Nondurable goods spending increased 2.8%. The most significant contributor was higher prescription drug outlays, reflecting intense interest in therapies such as weight-loss medications and rising demands from an aging population. That growth was tempered by a steep drop in motor fuel spending, as lower gasoline prices in Q2 pulled the category's overall gain down.

- In Q2 2025, spending on services increased by 5.5%, largely because of higher housing, utilities and medical care expenses. These areas are typically stable parts of household budgets, which helps support their market values and leads to ongoing cost increases. Because of this, consumers often have no choice but to spend more on these essentials, regardless of preference. Factors behind this rise include difficulties increasing the supply of new housing, higher energy demand from unexpectedly warm weather and the complex pricing of healthcare services, which caused insurers to take on extra costs during the quarter.

Inflation

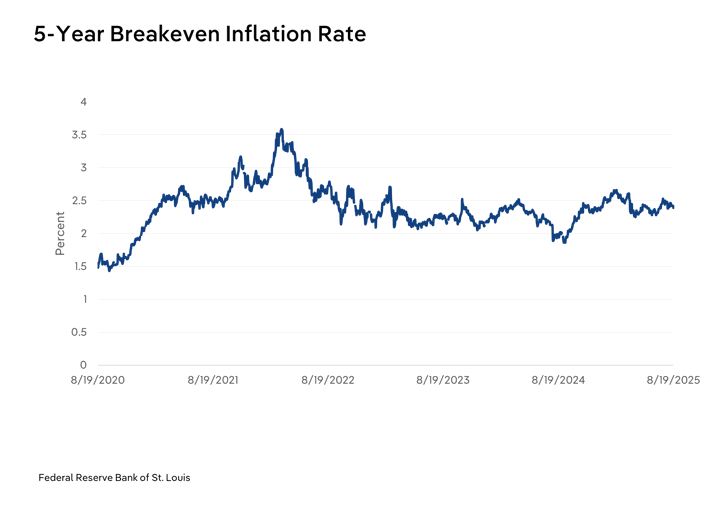

- Inflation remained a challenge, rising 2.5% yearly and 0.5% over the quarter. These readings were above the Federal Reserve's 2.0% target, limiting the scope for rate cuts and keeping interest rates elevated until clearer improvement emerges. Although tariffs were announced and implemented, their effects on prices typically occur with a lag. Businesses first work through existing inventories before new costs filter through, so Q2 price growth largely reflected pre-tariff conditions while inventories continued to cycle.

- Increased energy production helped stabilize some areas, and the consumer price index for gasoline fell 6.0% in the quarter, reaching its lowest level since Q3 2021. Gasoline prices declined year over year in the third quarter, extending the relief. This drop helped ease pressure on household budgets in the near term.

- Electricity costs, however, rose amid grid constraints and increasing demand linked to data centers and AI workloads that require large amounts of electricity. These factors contributed to a 2.8% quarterly hike in electricity costs. As power demand rises faster than capacity improvements in some regions, elevated electricity costs have become a pressure point for businesses and households.

- Food expenses increased 0.6% during the quarter. Prices for items like beef rose because of smaller cattle herds and lower import volumes of beef and veal, which reduced the overall meat supply available to domestic consumers. These supply constraints contributed to food inflation for these specific categories.

Residential construction

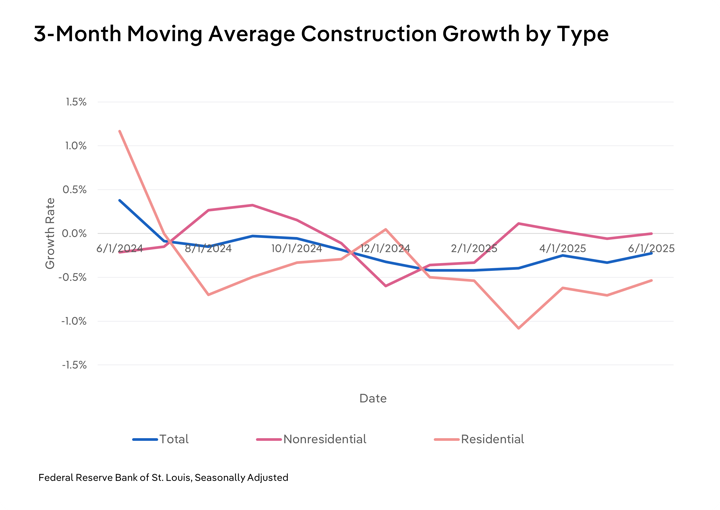

- The residential construction market continued corrections similar to the prior quarter, with investment falling 1.9% from Q1. Single-family starts declined, as elevated pricing and financing costs made these projects economically unfeasible for many first-time homeowners seeking affordable options. This shift pushed demand toward multifamily units, which saw a notable acceleration in starts during the quarter. Multifamily projects, while offering smaller units than single-family homes, can house more residents and help address housing demand while providing more competitive price points.

- Existing home prices remained high, with the median reaching $435,300, a record for June. Low housing inventory supported valuations at these levels. However, existing home sales fell 2.7% in June, reaching their lowest rate since September 2024. The drop was tied to affordability constraints, as prices remained too high for many average buyers under current rate conditions.

- New home sales also softened under elevated mortgage rates, limiting activity among higher-cost units. Sales fell by nearly 3.3% for the quarter. Even with an expanding supply of new housing units, prices remained firm because rates stayed elevated, influenced by Treasury yields that discouraged stronger sales. These financing conditions held back purchase activity, even as more units became available.

Nonresidential construction

- Mixed market sentiment led to a slight drop in nonresidential construction spending, down 0.04% in Q2 compared with Q1 2025. Some segments did post growth, particularly healthcare, which benefited from ongoing construction of special care units and assisted living facilities to meet the needs of the nation's aging population. Healthcare construction spending increased 0.1% during the quarter, reflecting the continued importance of these projects.

- In contrast, commercial and manufacturing construction spending declined. Higher interest rates and adding tariffs raised uncertainty about expansion prospects, especially for industries with significant trade exposure. This environment prompted caution, bordering on sharper pullbacks, as companies reassessed their plans and delayed expansion until they gained better control over costs and clearer visibility into policy and demand.

- Data center construction stood out with strong momentum. Spending on data center projects rose 8.5% over the quarter. Investors and developers viewed these facilities as providing long-term value. Policy support for such projects and increased investment in AI boosted the need for data centers and focused attention on this category throughout the year. As computing demands grow, these projects remain a key area of nonresidential construction.

Financial

- The Federal Open Market Committee kept interest rates unchanged at each quarter's meetings amid ongoing uncertainty. Concerns about stagflation were present, as tariffs risked keeping prices elevated while overall activity could slow. Policymakers emphasized the risk that inflation might rise again in the coming months, contributing to the reluctance to cut interest rates at this stage.

- The NASDAQ, S&P 500 and DJIA posted gains in Q2. AI- and data center-related themes supported strong performance among the prominent technology names often described as the "Mag Seven." Greater clarity around trade policies and pauses on certain tariffs also helped the Dow end the quarter on a solid note. These factors created a constructive environment for stock returns and improved investor sentiment.

- Equities overall had a good quarter, with Bitcoin leading among crypto assets. Supportive shifts, including the Trump Administration's appointment of Paul Atkins, a crypto advocate, as SEC chair and Coinbase's inclusion in the S&P 500, buoyed the asset class. Bitcoin outperformed during the quarter on these developments and broader interest in digital assets. However, on a year-to-date basis, gold and silver outpaced Bitcoin, reflecting investor preference for traditional safe-haven assets during periods of uncertainty.

Risk ratings

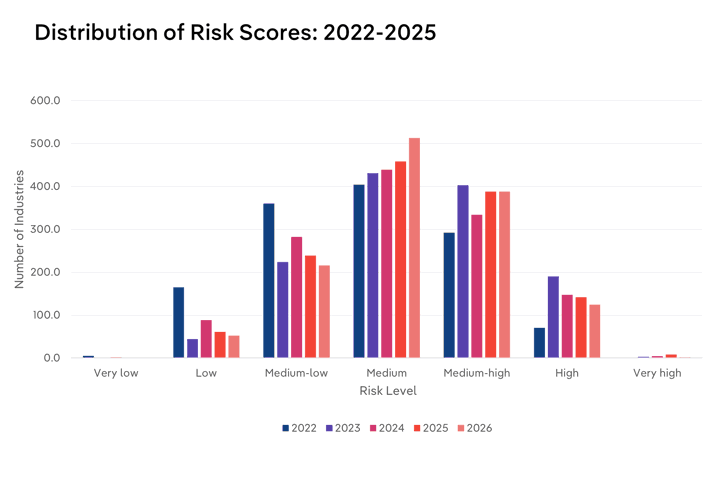

- Inflation and supply chain issues were consistently prominent in 2022. As such, 27.9% of industries were rated as medium-high or under greater risk as the world began to respond to such pressures on the economy.

- Since inflation remained an issue, interest rates scaled up in 2023. This led to nearly 46.0% of industries being rated as medium-high or even higher during the year, as markets struggled to respond to such factors.

- In 2024, inflation and interest rates contracted, with the latter starting to drop back in September. This reduction slightly lowered costs for businesses and consumers. But despite these cuts, YOY price growth was at 2.9%, slightly above the Federal Reserve's target rate of 2.0%, moderating these rate cuts. This enabled only a modest dip to 37.4% of industries classified as having a medium-high or higher risk throughout the year.

- In 2025, tariffs put the economy on a more volatile path. While trade deals and strategic pauses on certain tariffs provided partial relief, concerns about higher costs and weaker trade growth weighed on the outlook. As a result, 39.6% of industries were rated medium-high risk or higher, reflecting the combination of tariff-related cost pressures and uncertainty over trade-dependent growth.

Sector rankings

- Agriculture, Forestry, Fishing and Hunting: Drought conditions are expected to be a major constraint on growth for this sector. Rising concerns about screwworms will also likely limit cattle herd expansion, creating a mixed outlook. Tariffs raise input costs for farmers, and retaliatory measures on US exports from countries such as Canada hurt prospects in foreign markets. With tariffs in place, farmers are considering a greater emphasis on domestic markets and less reliance on international sales, which narrows long-term growth options. The Beef Cattle Production and the Wheat, Barley and Sorghum Farming industries face significant risks under these conditions.

- Mining: Tariffs are likely to raise material costs and reduce export opportunities for domestically mined products. The sector depends on machinery made from metals like steel, which was heavily affected by the Liberation Day tariffs, increasing financial risk for operators. In energy, ongoing water management requirements have constrained oil and gas drilling despite higher national production. Companies must separate and handle water that comes with oil extraction and comply with regulations for injection sites, increasing operational costs. These trends hurt Oil and Gas Field Services and Iron Ore Mining. Retaliatory tariffs on US steel by countries such as China and Canada further weaken the outlook for trade-reliant segments and add to the industry's challenges.

- Accommodation and Food Services: International travel to the United States may slow because of geopolitical tensions related to tariffs and stricter immigration enforcement, which increases scrutiny on travelers. This will impact tourism-dependent industries that rely in part on foreign visitors to support revenue. Persistent staffing shortages in hospitality, including hotels, limit the ability to expand, while tariffs raise input costs for food and equipment. Businesses in this sector will face the choice of absorbing higher costs or raising prices, which risks turning away budget-constrained customers. Caterers and casino hotels are especially vulnerable under these conditions.