Key Takeaways

- Defense modernization is reshaping America’s industrial base, driving rapid growth across aerospace, shipbuilding, electronics and advanced manufacturing.

- Rising geopolitical tensions and record military investment are accelerating demand for high-skill labor, secure supply chains and domestic production capacity.

- Industries from semiconductors to energy infrastructure stand to benefit as defense spending rewires the next decade of US economic growth.

US defense spending is entering one of its most consequential periods in decades. Rising geopolitical tensions, NATO’s new five percent spending benchmark and rapid advances in aerospace, missiles and cyber systems are converging to reshape the industrial base at home and abroad.

These shifts go far beyond traditional defense manufacturing. Aerospace clusters, electronics suppliers, energy infrastructure, R&D institutions and high-skill labor markets are all being rewritten by the scale and direction of defense investment. At the same time, consolidation, supply chain bottlenecks and cost pressures are reshaping competitive dynamics across the sector.

This new white paper, written by IBISWorld Senior Industry Analyst Evan Jozkowski, traces the full lifecycle of a defense dollar, from the Pentagon’s budget to the thousands of industries, workers and global supply chains it touches.

What’s in the white paper?

This comprehensive analysis breaks down the forces driving defense spending and identifies the industries positioned to benefit most from the next decade of modernization.

The current state of US defense procurement

US defense spending is anchored in six major procurement categories, each with its own cost structures, supply chain dynamics and modernization pressures. Together, these categories determine where the defense dollar goes and which industries stand to gain from rising budgets.

1. Aircraft

Aircraft remain the single largest procurement category, driven by sustained investment in air dominance and next-generation platforms. Programs such as the F-35, B-21 and the emerging F-47 under the Next Generation Air Dominance program are reshaping R&D priorities and expanding subcontractor networks across aerospace hubs. Aircraft spending also spans engines, components and large-scale sustainment, creating far-reaching opportunities for repair services, advanced manufacturing and precision engineering.

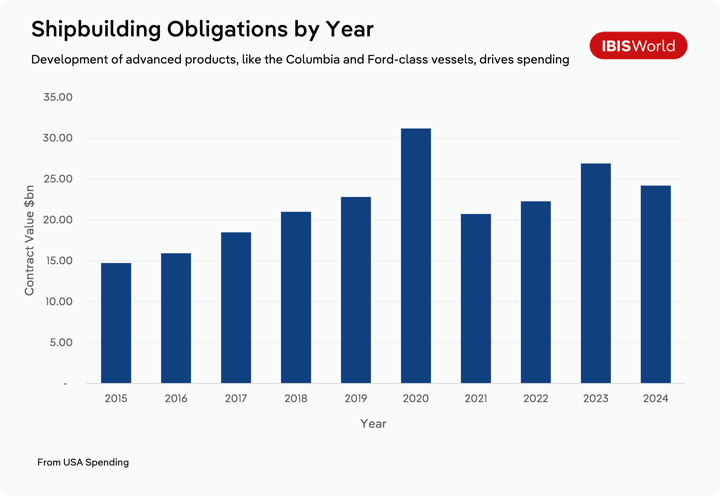

2. Naval platforms

Shipbuilding is one of the most capital-intensive and geographically concentrated segments of the defense budget. With only two US shipyards capable of producing nuclear submarines and aircraft carriers, naval programs carry significant cost, workforce and supply chain risk. Major initiatives such as the SSN(X), DDG(X) and Columbia-class submarines highlight how sole-source suppliers, labor shortages and infrastructure constraints influence timelines and procurement costs.

3. Missiles and long-range strike

Missile production has accelerated sharply due to global conflict and allied demand. Patriot, Javelin, HIMARS and the Sentinel ICBM system have each recorded major contract expansions as the US replenishes stockpiles and supports NATO partners. This category has become one of the fastest-growing sources of defense exports, with high R&D intensity and complex supplier networks spanning propulsion, guidance systems, electronics and advanced materials.

4. Land systems

Land procurement covers artillery, armored vehicles, personal protection and ordnance. Production of 155 mm artillery rounds has more than tripled since 2022, marking the largest scaling effort since the Cold War. The shift toward modular facilities, tracked vehicle modernization and new Marine Corps reconnaissance doctrines is reshaping demand for machining, robotics, workforce reskilling and component manufacturing.

5. Space systems

Defense space spending is expanding after years of stagnation, driven by the Space Force, the Artemis program and increased commercial-defense collaboration. SpaceX has disrupted traditional launch markets with reusable rockets, while NASA’s Lunar Gateway and Moon-to-Mars initiatives are creating a multi-agency industrial ecosystem. These programs have major implications for satellite production, propulsion, advanced sensors and domestic technology capacity.

6. C5ISR

C5ISR—command, control, communications, computers, cyber, intelligence, surveillance and reconnaissance—is now central to nearly every defense platform. Demand for semiconductors, sensors, microelectronics, cyber systems and advanced computing has surged, amplified by supply chain reshoring under the CHIPS and Science Act. Legacy electronics, rare earth dependencies and rising cyber threats have made this category a strategic priority for both the Pentagon and private-sector suppliers.

Where defense spending magnifies economic impact

Overseas exports and foreign military sales

The US accounts for 43 percent of global arms exports. The white paper explains how foreign military sales and direct commercial sales influence industrial capacity, ally relationships and long-term procurement planning.

Labor markets

Defense contractors face some of the most complex labor dynamics in the US economy. Security clearances, high-skill engineering needs and active union negotiations shape wages, project timelines and regional economic performance.

Local economic development

Defense hubs like St. Louis, Arlington and San Diego rely heavily on defense production. The paper shows how changes in defense programs can accelerate job growth or trigger structural unemployment, and why supply chain diversification is becoming a strategic necessity.

Which industries will benefit most

The white paper identifies five sectors positioned for long-term advantage as defense spending rises.

R&D and engineering services

High spillover returns on federally funded research are strengthening innovation and private investment.

Core industrials

Suppliers of specialty metals, machining and Mil-Spec components are seeing renewed demand as modernization scales.

Technology

Semiconductors, cyber systems, AI, sensors and advanced electronics all sit at the center of defense capability growth.

Repair and sustainment

Aircraft and naval repair markets are expanding as platforms age and production accelerates.

Energy and infrastructure

NATO’s new spending benchmark includes critical infrastructure, while the DoD remains one of the nation’s largest energy consumers. Microgrids, EV fleets and nuclear microreactors will play a growing role in installation resilience.

Why does this matter now?

The next decade will be defined by a rare combination of geopolitical tension, industrial constraint and technological acceleration. Defense spending is rising, but the system supporting it faces bottlenecks in labor, parts, materials and manufacturing capacity.

This paper explains the strategic shifts shaping these conditions and the industries poised to benefit as modernization programs expand.

Final Word

Whether you work in economic strategy, industry research, corporate planning, lending, consulting or investment analysis, this white paper offers essential context for understanding how defense spending shapes the broader US industrial base.

Download the paper to see where the defense dollar goes, how it flows through supply chains and which industries are positioned to gain most from elevated military investment.