Key Takeaways

- Despite surging AI adoption, significant productivity gains remain elusive, limiting AI’s impact on labour requirements.

- AI adoption remains highly fragmented in the UK, with the largest companies in the country spearheading the shift to AI.

- Knowledge work, particularly in less regulated industries like marketing, sales and tech, is set to be revolutionised by AI’s capability to complement human labour.

ChatGPT, which launched in November 2022, is the fastest-growing tech platform in history, with an estimated 100 million monthly users only two months after launch. The past three years have seen unprecedented development in AI’s capabilities to undertake increasingly complex tasks, causing AI models’ popularity to soar among businesses and consumers alike. By 2024, 79% of Britons reported using generative AI to help them at work. Given AI’s ability to speed up varied tasks and its outstanding rate of adoption in recent years, one of the most crucial questions is around how AI will affect labour.

The effects of the anticipated productivity gains are already being felt in the British labour market. There’s a marked slowdown in hiring and many companies have announced clear plans to replace jobs with AI. For example, in 2024, telecommunications giant BT announced plans to cut 55,000 jobs by the end of the decade, with the bulk of the cuts happening in the UK, where the company employs around 80,000 people, including replacing around 10,000 positions with AI to reduce costs.

At the same time, the UK government is boosting this trend by promoting AI investment, which has surged since 2022 as a result of stimulus measures like the British Business Bank’s Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS). This is set to continue, as the AI Opportunities Action Plan, published in 2025, outlines government efforts to boost AI adoption by enhancing infrastructure, unlocking data sets and ensuring safe AI development. With these developments, AI and labour are becoming inseparably linked, reshaping the future of work in the UK.

Automation, disruption, complementarity and AI

Automation generally means job transformation, not elimination. This is because the relationship between tasks and jobs is not one-to-one. Most jobs consist of multiple tasks and the connecting glue between tasks also contributes to the value of work. Hence, even when talking about the automation of certain tasks, that doesn’t necessarily mean the full automation and elimination of a job. Instead, this is more likely to lead to job transformation, in which workers spend less time on these tasks to focus on activities that cannot be automated. AI's influence on labour productivity can be assessed in two primary ways: automation and task complementarity.

Automation, which allows AI to take over specific tasks, reduces costs and often displaces human workers. Generative AI, for example, is set to automate tasks like text summarisation, data classification and analysis. Task complementarity, on the other hand, enhances productivity by augmenting human capabilities, thereby increasing the marginal product of labour, boosting the overall output of production with the same labour.

Top industries using AI in the UK

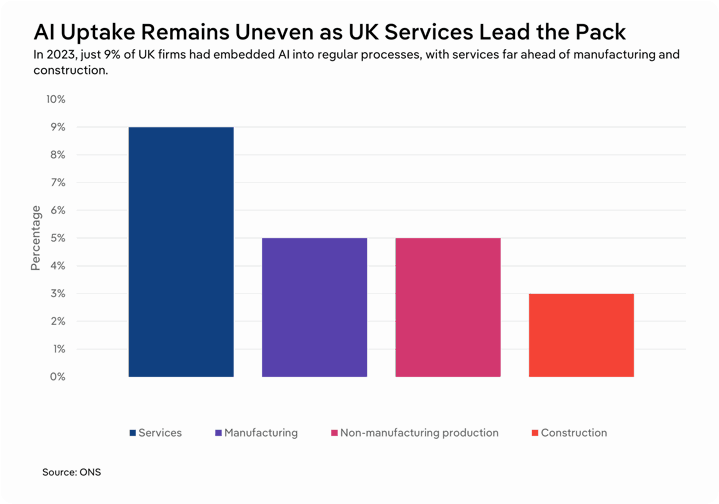

AI adoption in the UK remains highly fragmented. Only 9% of companies had adopted AI in 2023. This is partly because adoption has been very polarised, while 88% of companies in the top decile of management practice had adopted AI, cloud-based computing systems, robotics or other specialised software in 2023, only 51% of companies in the bottom decile had done so.

The projected adoption of AI saw a significant jump in 2024, rising to 22% of companies, making it the technology with the fastest adoption rate in the UK. Within this uneven landscape, a handful of industries are leading the charge, with three sectors in particular emerging as the UK’s frontrunners in AI adoption.

Marketing and sales

Few industries are as exposed to AI as marketing, where copywriting, campaign design and data analysis are increasingly handled by algorithms rather than people. Globally, approximately 88% of marketing professionals use AI to automate various processes, including writing, researching and communication tasks. The UK is following the same trend. Marketing and sales business functions have the highest uptake of AI in the country, with over half of sales and marketing professionals reporting using AI in their current roles in 2024.

The impact of AI adoption on the UK’s marketing and sales industry could be significant, given the sheer number of Britons working in this field. Around one-fifth of the country’s population is employed in sales, marketing and other service-related industries, meaning that a slowdown in the labour market for these jobs could severely reduce employment.

In the longer term, AI and automation have the potential to fully transform the sales and marketing landscape. For example, AI models could even change the traditional shopping and shipping model through anticipatory shipping models, like Stitch Fix, which uses AI to study customers’ styles and predict consumer fashion preferences, allowing for shipping before purchasing and cutting the need for many traditional sales and marketing roles. Adidas and Netflix also exemplify the broad applications of AI in the marketing and sales industry. Both companies use AI to analyse vast amounts of consumer data to identify patterns, trends and insights that can inform marketing strategies and campaigns.

Technology

The outlook in the UK technology labour market is fairly positive. More than a third of technology professionals used AI tools in their current roles in the UK in 2024. AI has also engendered new demand for technology professionals. For example, AI has become particularly important in the cybersecurity industry, mainly in response to cybercriminals adopting AI, which has led to a surge in the volume and sophistication of cyberattacks.

Another reason for general optimism in the technology sector is the increase in jobs related to AI development that fall within this sector. Employment in the AI sector surged by 29% in 2023, owing to a 17% rise in AI enterprises and a 57% increase in the sector’s GVA. However, when looking at the regional distribution in the UK, almost three-quarters of AI companies are located in London. In the long term, this trend could strengthen the existing regional disparities, by which London concentrates the highest salaries and the highest gross value added, far surpassing any other region in the UK.

Another key consideration is that new developments in generative AI technology could also threaten tech labour requirements. For example, Anthropic’s launch of Claude Opus 4.1 in August 2025 delivers state-of-the-art coding performance that surpasses all other available AI models and is capable of taking over several coding tasks, achieving a 74.5% success rate in fixing real model issues. While there’s still no data on the possible efficiency gains with these new models, a 2023 study of freelance computer programmers found that GitHub Copilot, an AI-powered coding assistance programme, allowed programmers to complete tasks 55.8% faster than the control group.

While these rapid developments could cause lower demand for skilled workers in the tech industry, the potential for work displacement remains on the horizon. Particularly for coding jobs, AI is still around a decade away from achieving important milestones that would replace human workers. This stems mainly from AI’s inherent current limitations. For example, coders need a semantic understanding of codebases (understanding the structure of the codebase and how every element interacts with each other and with the structure). However, most AI models lack persistent memory or an internal representation of the codebase’s architecture, making it impossible to maintain a consistent semantic understanding of the codebase.

Professional services industry

49% of professional services companies surveyed in 2024 reported regularly using AI. This, along with the numerous tasks that can be automated by AI in these knowledge-based occupations, has led many AI proponents to suggest that AI could soon replace many white-collar jobs.

However, many professional services that are often mentioned as candidates for AI automation are protected by professional licensing requirements that create significant barriers to AI substitution. In these cases, while task complementarity may not cause work displacement, a significant increase in productivity might prompt companies to reduce hiring in response to lower overall labour requirements.

For example, AI is deeply embedded in the financial services industry, where it is used in risk management, algorithmic trading, credit scoring and customer service. In many aspects, like trading, AI has surpassed normal human capabilities, with algorithms able to analyse market conditions and execute trades at lightning speed. Notably, the UK also houses a significant number of AI companies focused on the financial services industry, 17% of AI companies in 2024, making it the second-largest segment behind the technology and information industry.

Despite this, only 16% of professionals working in accounting and finance used an AI tool in their job in the UK in 2024. This aligns with the global 2024 estimate that approximately 65% of financial service companies were using AI in at least one business function; however, this was disproportionally focused on the marketing and sales roles within these companies rather than the knowledge management, service operations and strategy roles, where adoption was closer to 16 to 20%. So, AI adoption in professional services is expected to be largely concentrated on complementing specific tasks, boosting efficiency without fully replacing licensed professionals.

Wider impacts of AI adoption in the UK

AI can be a double-edged sword for workers and the labour market. On the one hand, it can make companies more productive, which in classic economic theory should increase demand for labour, creating more jobs. On the other hand, it can replace workers by taking over tasks that they once performed, reducing the total number of workers needed in an industry or profession. The overall impact of AI on the labour market depends on which of these forces dominates. If AI is mainly used to cut costs and no new tasks or professions emerge, the result could be fewer jobs overall. In the case of the UK, this could be a potential concern, as among the organisations using AI in the UK, 69% planned to use AI to upgrade processes and methods and 42% planned to use AI to automate tasks performed by labour. Only 24% of these companies planned to use AI to expand the range of goods and services.

When it comes to wages, in theory, wages tend to rise in line with productivity, supporting economic growth in the long run. In reality, this depends largely on market structures, workers’ bargaining power and aggregated labour demand. Recent research suggests that the productivity boost from AI might be smaller than the hype implies. AI is forecast to raise productivity by no more than 0.71% between 2024 and 2034. This modest estimate is in line with the so far elusive productivity gains from AI use. While AI adoption is rising, many companies report little to no change in productivity. Overall, this below 1% productivity increase is likely to have a negligible impact on wages.

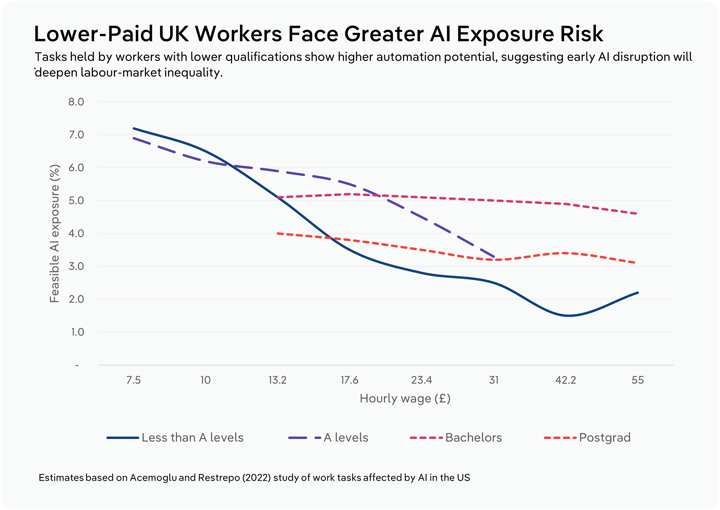

But the picture isn’t entirely rosy. Even when productivity rises, workers can still lose out if the very tasks they are good at are automated. If lower-skilled workers see large productivity gains in tasks that AI can quickly take over, they could be displaced faster than higher-skilled workers. The end result could be a widening of inequality, especially between workers and the owners of capital (like investors and firms), who stand to benefit most from AI.

Observed hiring trends also indicate another concerning ripple effect of AI adoption: a reduction of entry-level positions. In the UK, entry-level roles face significant challenges, exacerbated by the broader economic slowdown. The reasons for this are two-fold: firstly, AI is currently only capable of taking over simple tasks that relate more closely to young workers; secondly, historical data shows that youth unemployment tends to rise faster and recover more slowly during economic downturns. So, while the UK’s overall unemployment has risen from 3.8% in the three months ending in April 2022 to 4.6% in the same period in 2025, the rate for those aged 16 to 24 has gone from 10.9% to 14.3%. If companies decide to reduce the number of new hires in the long term, hoping for productivity gains from AI, this could be particularly problematic, as it may cause a significant loss of skilled young talent.

Final Word

When it comes to predicting the future of AI development and how these will reflect on the labour market, the process is fraught with uncertainty. Factors like future discounting, unexpected events and simple errors of judgment can result in widely different forecasts.

Overall, AI’s capabilities suggest that knowledge work will be the most affected by these rapidly evolving technologies. However, AI is more likely to boost productivity by complementing tasks rather than by automating them. This means that a significant displacement of labour is unlikely with the current AI capabilities.

Still, the trajectory is clear: AI and labour are now inseparably linked in the UK, with productivity gains reshaping work patterns, hiring needs and the value of human expertise. The challenge ahead lies not in resisting this shift, but in managing how technology and workers evolve together.