Key Takeaways

- The aged-care sector saw the largest revenue increase on the back of an ageing population and rising government spending on residential care services.

- Higher interest rates have spurred businesses to search for more flexible and less stringent financing in the private lending space at the expense of higher borrowing costs.

- Multi-unit construction remains uncertain, with completion rates subdued across most of Australia.

- Pallion jumped to pole position, recording a 94.6% skyrocket in its revenue to $18.4 billion as gold and silver prices surged 45% and 30%, respectively, over the year and volumes grew.

Welcome to IBISWorld’s 2025 special report on Australia’s Top 500 private companies.

Despite a financial year dominated by high interest rates, Australia’s private sector proved resilient. Rates remained elevated for most of the financial year, before easing in February as inflation started to fall into the RBA’s target range, reducing borrowing costs for consumers and businesses.

Consumer sentiment rebounded on the back of wage growth and slowing inflation, yet it remained below historical averages. Business investment was flat, with significant global factors – like lower demand for Australia’s exported commodities and increasingly fragmented and uncertain global trade – still weighing on business choices. Government spending did a lot of the heavy lifting this year in contributing to GDP growth, particularly benefiting commercial and heavy construction. Other areas of notable growth were aged care, data centres and non-depository lenders.

In this special report, we explore key trends and spotlight the biggest movers of 2024-25. As we look ahead, these insights offer valuable indicators of where Australia’s private sector is heading.

To download IBISWorld’s Top 500 Private Companies List, fill out the form above.

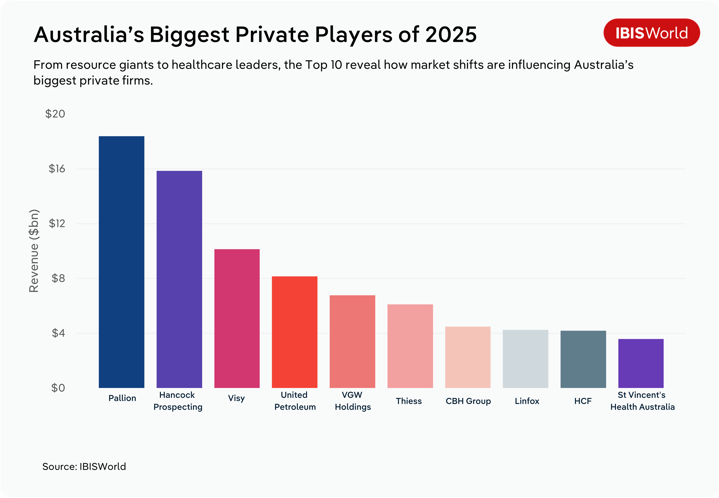

Inside the top 10

The top 10 private companies had only one new entrant this year, St Vincent’s Health Australia, which jumped from 12th to 10th place, generating consistent revenue growth amid rising national healthcare budgets.

But this year’s headline change is Pallion’s rise to the top spot. A 94.6% spike in the company’s revenue to $18.4 billion, on the back of strong gold price growth and increased volumes, vaulted Pallion to 1st place, leapfrogging Visy (#3) and ousting Hancock Prospecting (#2), which had held the top spot since 2020.

The top 10 companies in the list generally posted strong results despite shaky economic conditions across the economy. CBH Group (#7) was the only company to experience a large revenue decline, amid falling grain prices and a weak growing season in 2023-24, while Hancock Prospecting’s revenue dropped slightly as weaker iron ore prices weighed down its performance.

The remainder of the top 10 posted positive results, with VGW Holdings (#5) joining Pallion in once again having double-digit growth. Revenue concentration remains apparent, with the top 10 companies generating $81.9 billion in revenue, almost equal to the bottom 300 combined, while the top 50 account for nearly half of total revenue. However, while some top companies had record-setting years, the broader outlook in many sectors is still unclear, with persistent headwinds present across the economy.

Where the Top 500 call home

Beyond the headline shift at the very top, the distribution of companies across states and territories shows how concentrated Australia’s private sector remains. New South Wales and Victoria collectively account for almost two-thirds of all companies on the list. Meanwhile, Tasmania, the Australian Capital Territory and the Northern Territory together account for just 2.4%. Victoria’s share of all 500 companies is almost double its share of the top 50 companies, indicating that many medium-size businesses are represented in the state.

Western Australia had the weakest results in terms of the average revenue change, with a 25.8% plummet in revenue from grain storage and supply chain company CBH Group (#7) dragging down the state’s results. The state performed well overall, with just under 10% of companies based in Western Australia reporting a revenue decline, compared to 15% across all companies on the list.

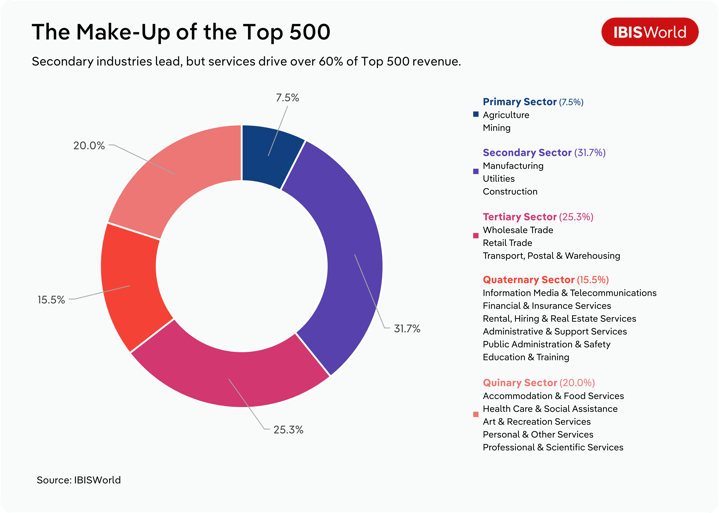

The bigger picture

The total revenue for the Top 500 in 2025 comes to $396.3 billion, an increase of 6.6% from the previous year. While total revenue still grew, the rate of growth continued to slow, from 7.0% and 20.3% in 2024 and 2023, respectively – though some of the stronger growth in previous years occurred as part of the recovery from the pandemic.

Amid weaker economic conditions, Australian private companies in the Top 500 have remained remarkably resilient this year, with 85.0% of the top 500 companies showing growth, largely in line with the 86.6% of 2024. The average revenue growth for a company on the list was 6.0%, down from 7.6% in the previous year.

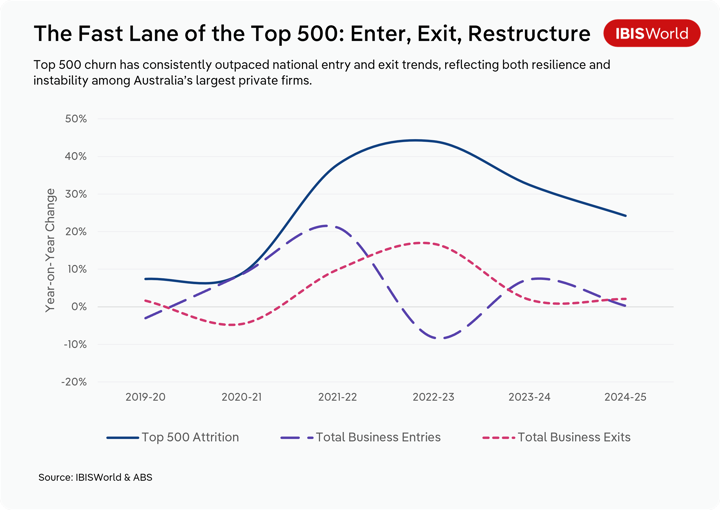

High turnover reshapes the Top 500

The attrition rate among the Top 500 has been volatile over recent years, rising from just 8.8% in 2020-21 to 37.8% in 2021-22. After peaking at 44.0% in 2022-23, it eased back to 24.2% in 2024-25. In practice, this meant that in 2024-25, nearly one-quarter of all companies either dropped out of the list or restructured – more than three times the churn seen in the pre-pandemic era.

Attrition doesn’t just come from struggling revenue growth, but also from mergers, acquisitions, partnerships and business exits. While inflation has eased, persistent cost pressures and a tight labour market have continued to push businesses to rethink their footing. In 2024-25, the attrition rate partly reverted towards the mean, yet it remains higher than pre-pandemic levels, highlighting the fierce competition to remain within the list. Companies must balance growth opportunities with the risks that continue to characterise conditions across the market. Many have responded by consolidating, pursuing acquisitions or partnering with peers to find new ways to grow.

One such company changing strategy is the Royal Automobile Association of South Australia (RAA), which partnered with Allianz Australia. Under the partnership, Allianz Australia took over the underwriting activities of RAA, which has the challenge of being a local player in the global insurance market, with all its risk concentrated in one state. The partnership with Allianz has allowed RAA to move some of this risk off its books, enabling it to focus on member outcomes. Although this action didn’t result in RAA leaving the Top 500 list, it led to a 61.2% plummet in the company’s revenue.

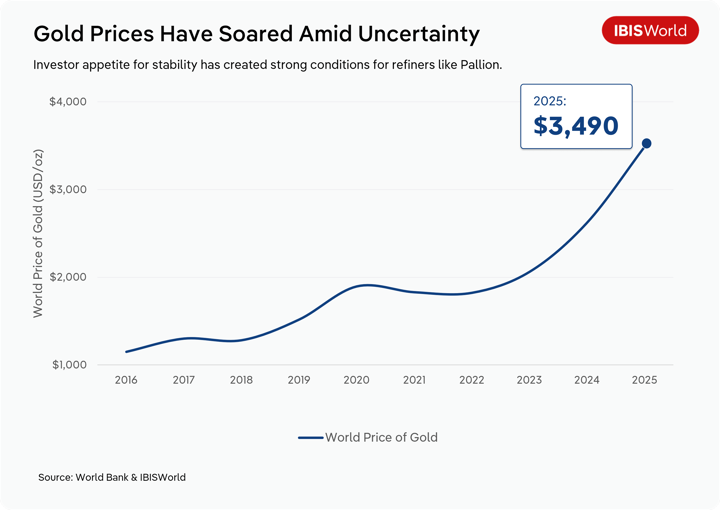

Pallion shines as gold prices climb

The broader list shows steady growth, but Pallion’s (#1) leap to the top spot highlights how global market forces can reshape the rankings in a single year. The company, a precious metal refiner and jewellery manufacturer, shot up to the number one spot on the Top 500 list, after rising from 4th to 3rd place in 2023-24. Pallion’s revenue jumped 94.6% year on year, driven by higher business volumes and historic gains in precious metal prices, with gold up 67% and silver increasing 27% over the past two years.

Precious metals, including gold and silver, remain a cornerstone of investor strategy during periods of volatility, valued for their stability when traditional assets lose ground. Their limited supply and universal acceptance as a store of wealth make them especially attractive in uncertain times.

A storm of pressures in recent years, from inflation and tariffs to global trade disputes and geopolitical tensions, has prompted investors to shift capital into safer asset classes, like precious metals. This renewed appetite for refined metals created strong conditions for companies positioned at the heart of the value chain, and Pallion was no exception.

Beyond the resource boom, demographic forces are reshaping the list, too, with aged care emerging as one of the fastest-growing sectors.

Aged care companies boosted by government funding and acquisition activity

Despite persistent economic headwinds, the aged-care sector was again a strong performer. Aged care saw approximately 15% growth, the largest growth from any sector apart from mining, which was highly inflated by Pallion’s results.

Labour challenges bite

Yet behind this growth, significant workforce pressures continue to beleaguer the aged-care sector. If current trends continue, the sector could face an estimated shortage of 100,000 care workers by 2027-28, driven by a high attrition rate and low relative wages. But despite challenges, increased spending on aged care, particularly by the government, has led to continued revenue growth, and government efforts – including wage increases – are providing some support towards building up the aged-care workforce.

The Australian Government collectively spent $36.4 billion on aged care in 2023-24, of which 59% ($21.5 billion) went towards residential care services. The government contributed as much as 75% of all revenue generated by residential aged care companies in Australia in 2022-23.

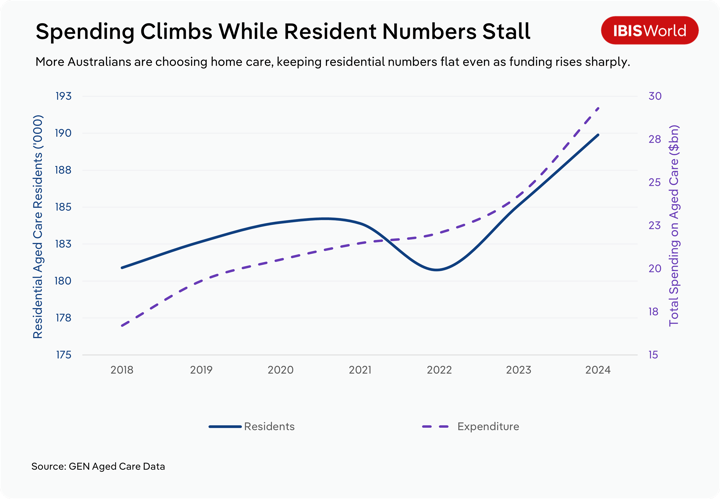

Service prices for aged care contributed to much of the growth for aged-care companies. Between 2018 and 2024, the number of residents in permanent residential aged care grew nearly 5% as more consumers opted for home care services. On the other hand, spending per resident increased almost 20% over that same period, underpinning the majority of sectorwide growth.

Looking ahead, an ageing population presents a future growth opportunity for the industry, and larger companies are engaging in acquisition activity to expand their foothold in the sector.

Consolidation in focus

Individual companies have driven growth through acquisitions, exemplified by Opal HealthCare (#43). The company has consistently performed well, with three- and five-year average growth rates of 25.9% and 20.7%, respectively. BlueCross’s residential and home care services became a part of Opal HealthCare in July 2024, building on momentum from Opal HealthCare’s purchase of five residential communities from Cranbrook Care in 2023-24 and raising its total number of residents to 12,000, up from 10,300.

The aged-care sector has a strong potential for growth. Over the next 20 years, alongside rising government support for the sector, the number of Australians aged 70 and over is expected to grow 68%. Residential aged care providers will need more of this demographic to opt for residential aged care over home care in the coming years to help realise continued growth.

Although the waitlist for home care packages has steadily declined since 2019, wait times have been increasing since 2023, signalling capacity pressures in the system that may push more demand for care towards permanent residential solutions. With 88,000 people still on the waitlist at the end of the third quarter of 2024-25, this presents an opportunity for residential care providers. For now, acquisition activity and pricing increases due to higher costs have provided most of the sector’s growth.

Data centres race to keep up with AI growth

While increased costs and acquisitions are driving growth in aged care, a changing world is fuelling demand from tech companies. Big data, cybersecurity and AI are propelling massive demand for data centres and the latest tech products. Demand for data centres, in particular, is sparking a national conversation about future capacity and data centres’ impact on the environment and electricity networks. Over the next five years, data centre capacity is set to double, with AI adoption and migration to the cloud driving demand for as many as 350 new facilities in Australia, requiring a $26 billion investment, according to JLL.

The magnitude of expected demand growth is provoking a rising conversation about how to power these investments, with Morgan Stanley estimating that as much as 8% of Australia’s electricity generation capacity will be used by data centres by 2030, up from approximately 2% in 2023-24. A significant portion of data centres’ power consumption comes from the need to cool data chips and servers. Data centre companies are exploring ways to make this process more efficient through liquid cooling techniques, but this will not be enough to avoid a spike in electricity demand.

However, future concerns aren’t holding back data centre and tech companies. CDC Group (#187) has rapidly expanded its data centre footprint in Sydney and Auckland. It also opened its first location in Melbourne in 2024 and began the construction of a second data centre in early 2025. The company is planning for further major capacity expansions in Canberra, Sydney and Auckland over the three years through 2028 amid soaring demand. CDC Group’s expansion of its operations delivered 31.0% revenue growth in 2024-25, contributing to a three-year average growth rate of 18.2%.

Leader Computers (#114), a major computer wholesaler, posted strong growth of 18.3%, benefiting from more companies and consumers upgrading their hardware. Meanwhile, ASI Solutions (#404), a cloud computing and IT infrastructure solutions company, achieved a 23.5% revenue expansion, with an average growth rate of 19.6% over the past three years. The company’s new GPU-as-a-service offering has successfully positioned it to capture opportunities in the emerging AI era.

While technology companies are expanding capacity at breakneck speed, the housing sector is struggling to meet even modest targets.

Dwelling shortfalls show no sign of easing

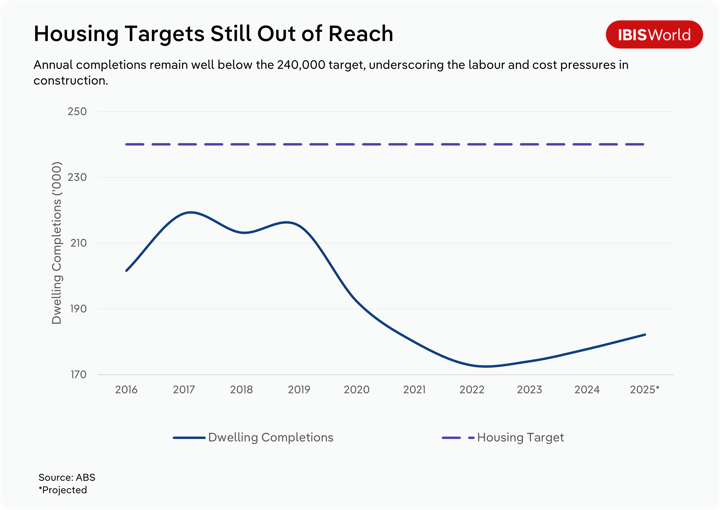

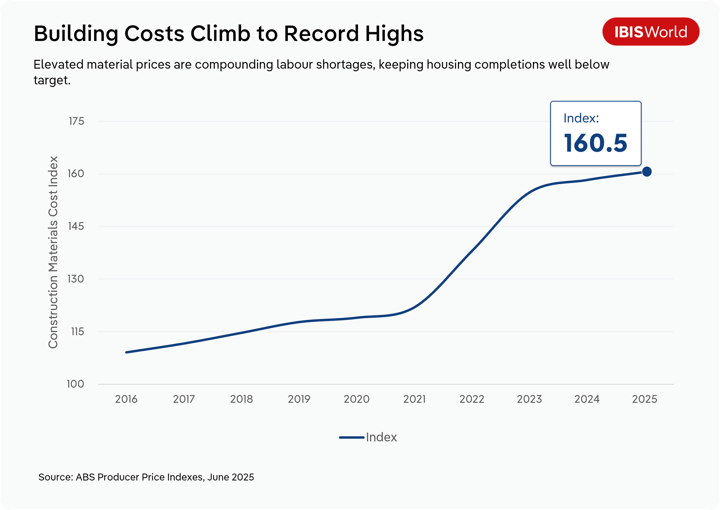

Amid mounting housing shortages, the government has tried to put the pedal to the metal on residential construction, but the sector is struggling to gain traction. Labour shortages (much like those in aged care), higher costs and regulatory hurdles have all weighed on the sector in recent years, contributing to stagnant housing completions, which currently sit at well below pre-pandemic levels.

In this environment, the government’s target of 240,000 houses a year through 2029 seems well out of reach. Even before the pandemic, the target would have been ambitious, and recent conditions make it almost impossible. The government isn’t sitting still, however, and new policy proposals are being discussed at the Economic Reform Roundtable. But for now, the construction sector has failed to lift off.

Sectorwide strains

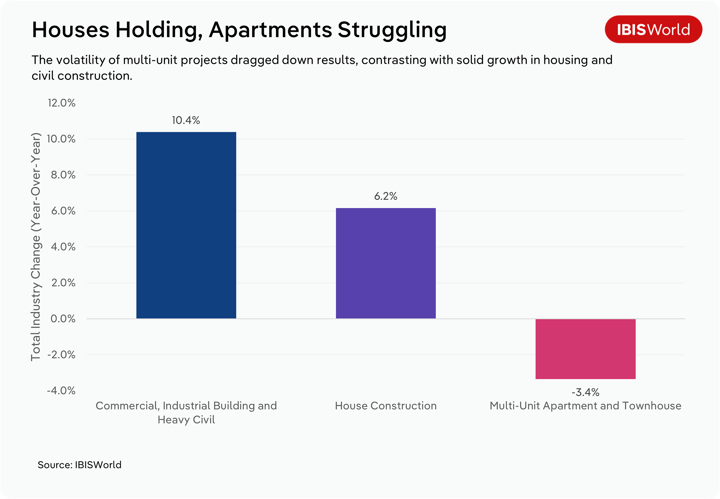

Despite the difficulties faced by the construction sector, Australia’s top house construction companies fared relatively well. Revenue growth among housing construction companies on the list sits just under overall growth in 2024-25, at 6.8%. This included the standouts Ausbuild (#212), which posted revenue growth of 21.9%, and JWH (#226), with 12.5%.

Companies with a greater focus on multi-unit construction had slightly more weakness than those in other construction industries, recording a total average revenue drop of 3.4%. Multi-unit dwellings tend to see more volatility year to year as projects, which take multiple years to complete, are either started or finished.

This year, Dasco Australia (#403) scored growth of 29.9%, while SEE Group (#144), a company with deep roots in civil works for land development, achieved an 82.7% revenue spike, bolstered by its acquisition of Hall Contracting's civil infrastructure division. On the other end of the scale, however, revenue for Meriton (#28) declined 12.3%.

Mixed fortunes for the top builders

Many of the construction companies on the Top 500 list are among the strongest performers in their industries, with the scale, capital and brand recognition to withstand any short-term headwinds. But their performances don’t reflect the wider construction sector, which continues to face significant challenges.

Construction completions remain weak, construction costs are climbing and insolvencies are on the rise. More than one-quarter of all company failures in 2024-2025 came from the construction sector, rising more than 20% year on year to reach almost 4,000 companies, up from just over 2,000 companies in 2022-23.

The same high interest rates that are weighing on housing construction are also reshaping how Australians finance property, opening the door for non-bank lenders.

Consumers and businesses look beyond banks as rates bite

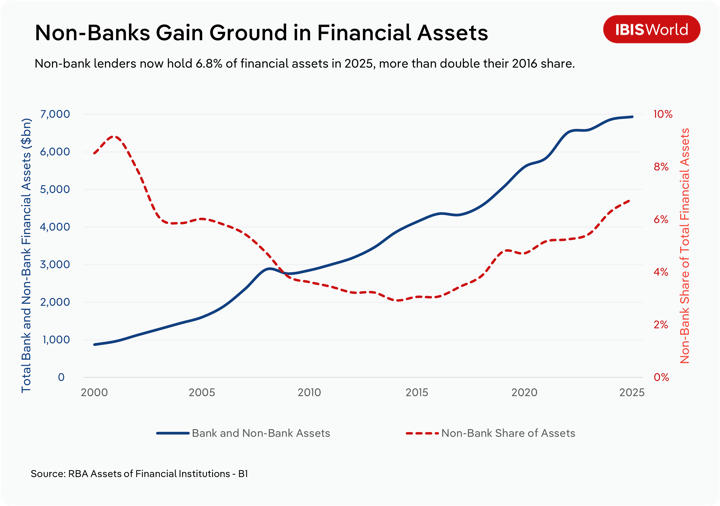

Non-bank lenders in Australia have been growing at a consistently fast pace over the past few years, averaging double-digit growth since 2015 – more than twice the rate recorded by banks. The expansion of non-bank lending has been inadvertently cultivated by the Australian Prudential Regulation Authority’s (APRA) revised operating framework for major banks, which was introduced in 2023.

The rules require banks to hold more capital and test whether borrowers could still repay their loan at an interest rate at least 3.0% higher than the one being offered (up from the previous 2.5%), effectively tightening who can qualify for a loan. This has reduced the pool of eligible customers for the major banks, creating opportunities for non-bank lenders not bound by the same restrictions. With rates elevated for the majority of 2024-25, businesses increasingly sought financing sources away from traditional banks. However, small-to-medium enterprises that switched to non-bank lenders faced higher borrowing costs, primarily because non-bank lending is directed to businesses with a higher risk profile not touched by the major banks.

The non-bank share of financial assets has grown from approximately 3.1% in 2016 to 6.8% in 2025, surpassing pre-2008 global financial crisis levels. This growth has been financed in part by strong investor confidence in the underlying assets and the returns offered. Non-bank lenders issued a record $34 billion in mortgage-backed securities across 41 deals in 2024, with the average deal size growing 10% year on year.

As non-bank lenders continue to focus on tailoring their products and catering to more niche markets, the industry is poised to capture segments overlooked by the major banks and traditional finance.

Alternative paths to home ownership fuel the non-bank surge

Non-bank mortgage lenders are one group capitalising on demand for greater flexibility and faster approvals, filling gaps in the market left by stricter regulations on traditional banks. The worsening housing affordability crisis is turning more Australians towards these alternative non-bank lenders to access credit.

ColCap (#77) saw its revenue grow 24.6% in 2024-25, lifting the company from 90th to 77th place. Through the acquisition of majority-owned Molo Limited, a mortgage application platform, ColCap was able to expand its total funds under management from $12 billion in 2022 to more than $15 billion in 2024.

Athena Home Loans (#436) is another strong performer, with revenue growth of 18.3% year on year and a five-year annualised growth rate of 52.5%. These performances show how investor confidence and borrower demand are combining to fuel a rapid expansion among non-bank lenders.

Final Word

IBISWorld’s Top 500 list demonstrates the resilience of many Australian companies and their ability to generate revenue growth in uncertain times. Aged care has once again seen some of the strongest revenue growth, backed by government spending and the need to pass on rising costs.

Dwelling completions are still well below the pre-pandemic levels, and reaching government targets is further out of view. Labour shortages and rising material costs continue to plague the construction sector. While some of Australia's biggest companies can weather the storm, many smaller players are showing increased volatility as projects begin and end.

Non-bank lenders have delivered impressive growth, catering and tailoring products to niche markets and complex clients that the major banks don’t or cannot lend to.

Looking ahead, with inflation subsiding, further rate cuts are a certainty. However, interest rates are only one piece of the broader economic mosaic, and there are still fundamental issues across the economy, including skills shortage, the cost of living and weak productivity growth.