Key Takeaways

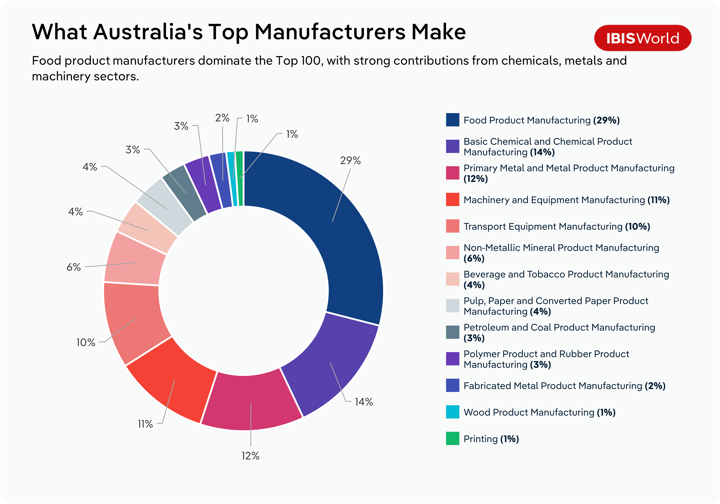

- IBISWorld’s 2025 Top 100 Manufacturers List comprises the highest-revenue-earning enterprises from across 62 industries within Australia’s manufacturing sector, with a combined revenue of $376.0 billion.

- Pharmaceutical product manufacturing in Australia prospered through targeted R&D spending, with leading manufacturers like CSL expanding their biologics capacity and forging global partnerships.

- Iron and steel manufacturing slumped and is set to continue slowing down as the top iron ore-exporting nation, China, tends towards high-grade green steel as part of its efforts to reach carbon neutrality by 2060.

- Investments in AI and automation in the Meat Processing industry helped lift revenue by enhancing operational efficiency.

IBISWorld’s 2025 Top 100 Manufacturers List showcases Australia’s leading producers across 62 manufacturing industries: from food and beverage to building materials, chemicals and transport equipment. Together, these manufacturers generated approximately $376.0 billion in revenue in 2024, up 5.3% on the previous year’s $357.0 billion. This growth was underpinned by strong pharmaceutical exports, surging demand from defence and infrastructure projects, and price-driven gains across key commodities like cement, fertiliser and meat.

The Pharmaceutical Product Manufacturing industry once again reaffirmed its dominance, remaining the most represented industry in this year’s list, with six companies placing in the top 100. CSL Limited rose to third place, benefiting from strong patient demand for immunoglobulin (Ig) products through its CSL Behring segment.

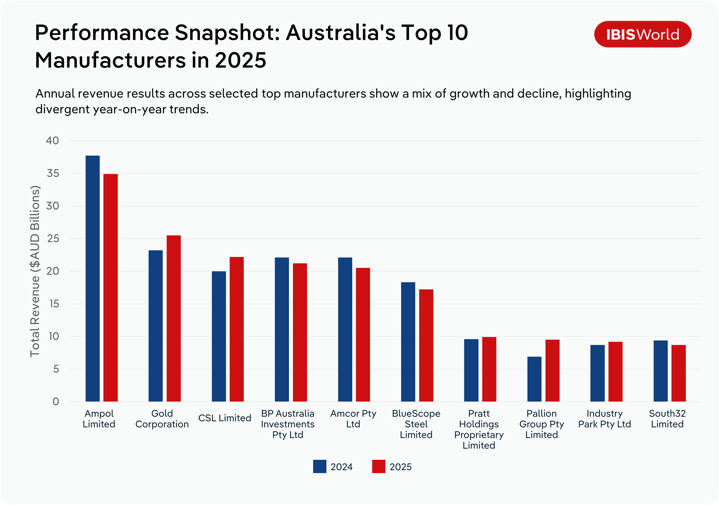

While pharmaceutical manufacturers saw significant gains, some of the list’s largest petroleum producers moved in the opposite direction. Although Ampol Limited (1st) and BP Australia Investments Pty Ltd (4th) held their spots in the top 4, both experienced revenue declines, down 7.5% and 4.1%, respectively. Falling crude oil prices and ongoing domestic supply disruptions weighed down their performances, and maintenance at Ampol’s Lytton refinery also hampered its performance, contributing to a 12% drop in its production volumes to 5.3 billion litres.

This year’s list highlights how commodity price swings, automation advances and other economic headwinds continue to shape Australia’s manufacturing landscape.

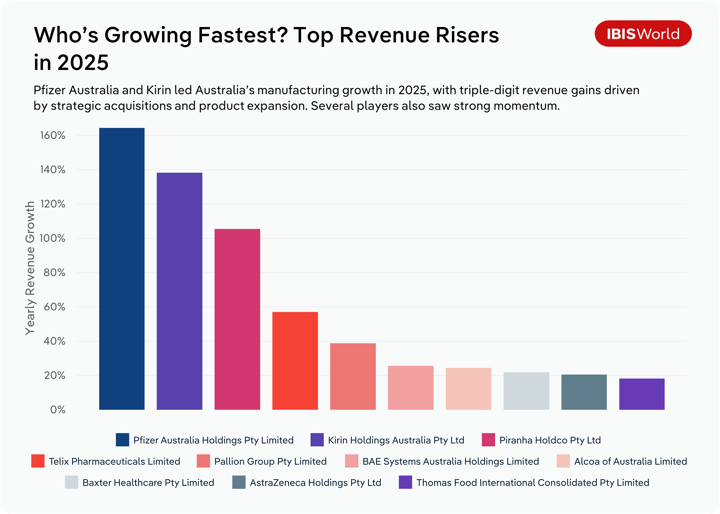

Biggest mover: How Pfizer more than doubled its revenue

Pfizer Australia Holdings Pty Limited (67th) achieved the most significant growth of industries across Australia’s manufacturing sector, with its revenue skyrocketing 164.4% from the previous year. The transfer of assets from its related party, Pfizer PFE Australia Pty Ltd, boosted its sales revenue, driving this growth.

The company’s expansion of its product portfolio and digital capabilities through acquisitions of various pharmaceutical assets, particularly ResApp Health Limited in late 2022, propelled it forwards. These acquisitions supported its disease prevention initiatives and the development of new and improved medicines and vaccines.

Strategic investments in mRNA vaccine platforms, digital health tools and high-demand respiratory products enabled Pfizer Australia to secure a strong position as a major performer in this year’s edition of the list.

Looking ahead, Pfizer Australia’s growth trajectory will likely be shaped by the commercial rollout of new products, like its RSV vaccine, and its expanding network of digital health partnerships. This forwards momentum is reflective of broader trends across the pharmaceutical sector.

Pharma’s growth engine: R&D spend and product demand

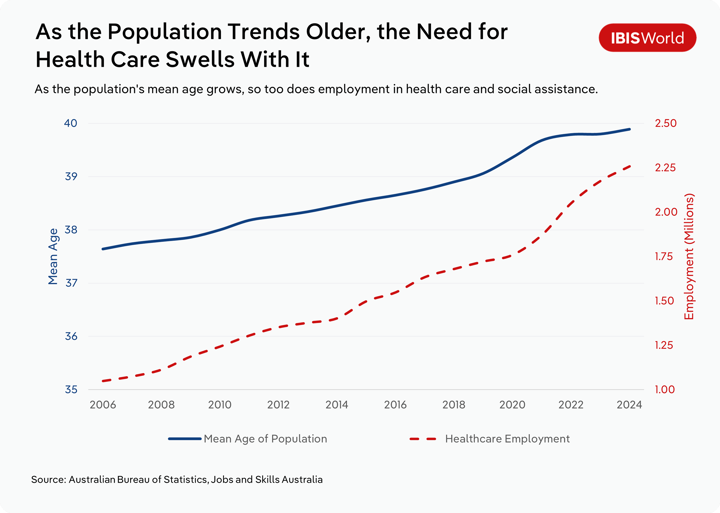

Australia’s Pharmaceutical Product Manufacturing industry continues to be shaped by strong demand for high-value therapies, particularly in immunology and blood products. In 2024, the industry benefited from rising patient demand, ageing demographics and sustained investment in research and development.

Backed by the Federal Government’s R&D Tax Incentive, firms are intensifying their focus on clinical trials and biologics development. These efforts are paying off – the industry’s six top-ranked companies generated a combined $26.7 billion in revenue. CSL was a standout performer in 2024, placing third overall on the Top 100 list.

What’s driving growth in pharma?

Pharmaceutical companies in Australia have benefited significantly from two structural trends: surging R&D investment and strong demand driven by an ageing population. By 30 June 2024, Australians aged 65 and over comprised approximately 17% of the population, up significantly from 12% three decades earlier. This demographic trend is projected to intensify, with that share forecast to reach 24% by 2064-65. An ageing population is fuelling demand for treatments targeting age‑related conditions, immunodeficiencies, neurological disorders and cardiovascular diseases, reinforcing R&D-driven growth in the Pharmaceutical Product Manufacturing industry.

The Federal Government’s Research and Development Tax Incentive (RDTI), introduced in 2020, continues to drive innovation across Australia’s Pharmaceutical Product Manufacturing industry. The scheme encourages eligible companies to undertake clinical trials and other R&D activities by offering generous tax offsets, which help improve profit margins and accelerate product development.

CSL: A standout performer in 2024

CSL Limited, one of Australia’s largest biopharmaceutical companies, has strongly benefited from this environment. The company spent approximately US$1.4 billion towards Research and Development in 2023-24. CSL’s strong focus on R&D has enabled it to develop innovative medicines like immunoglobulin products, which treat various immunological and neurological diseases. Heightened global demand for the immunoglobulin (Ig) therapies produced by its CSL Behring division led to a 14% uplift in the segment’s sales revenue, contributing to the 11.9% revenue growth CSL recorded in 2024. This positive performance reflects CSL’s ongoing investment in R&D, which remains central to its strategy of addressing unmet medical needs and advancing treatments for complex immunological and neurological conditions.

The Pharmaceutical Manufacturing Industry has increased its spending towards Research and Development activities, which accounted for 31% of the total expenditure during 2022-23. This R&D intensity reflects the industry's reliance on innovation to develop high-value therapies and maintain strong profit margins across patented, specialty products.

In contrast to more commodity-exposed industries, pharmaceutical product manufacturers benefit from stronger pricing power and robust export opportunities. The industry’s consistent growth is underpinned by rising demand for biologics, vaccines and therapeutic treatments, along with structural drivers like an ageing population and Australia’s focus on sovereign medical capability. A continual commitment to innovation, particularly in biologics, is likely to support both CSL’s performance and the Pharmaceutical Product Manufacturing industry’s ongoing growth in the years ahead.

Iron and steel revenue slides amid global shifts

Weakened global demand, falling iron ore prices and a shift towards green steel have hit Australia’s Iron Smelting and Steel Manufacturing industry, with many companies experiencing an overall revenue decline. BlueScope Steel Limited (6th), Liberty InfraBuild Limited (19th) and Liberty Primary Metals Australia Pty Ltd (31st) recorded revenue drops of 6.2%, 12.3% and 2.4%, respectively.

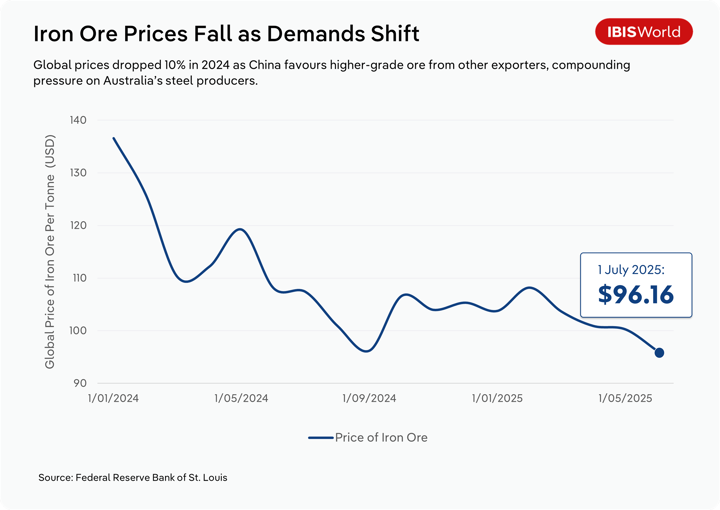

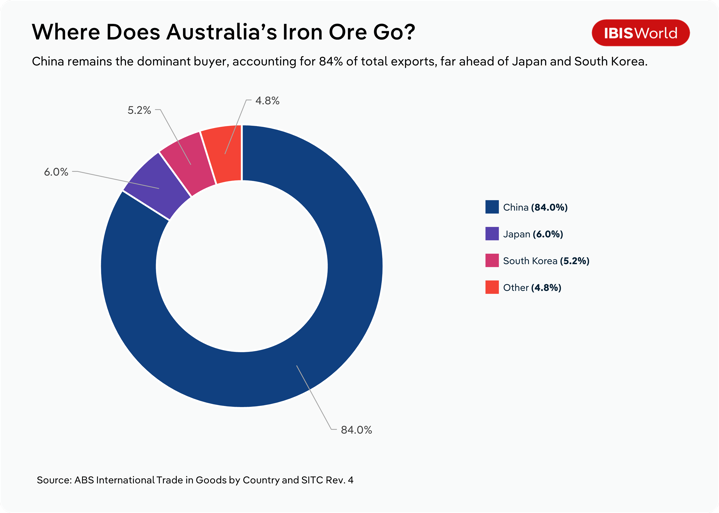

China is Australia’s major exporting nation for iron ore, accounting for approximately 84% of the total exports. Export volumes to China rose 2.0% in the first nine months of 2024, reaching 514 million tonnes. However, this increase masks a broader shift in China’s demand away from Australia’s lower-grade iron ore as China increasingly favours higher-grade ore from competitors like Brazil and Guinea. This transition supports the Chinese Government’s ‘dual carbon goals,’ which aim to peak steel industry carbon emissions before 2030 and achieve carbon neutrality by 2060. The effects of slowing demand from China have, in turn, significantly impacted iron ore prices, which were down 10% during 2024 and sit at US$96.16 per tonne as at 1 June 2025.

Australia’s Iron Smelting and Steel Manufacturing industry felt the negative impacts of stagnant demand from China, its top export destination, as part of the shift towards green-steel practices. This led to falls in sales revenue, particularly in international segments across companies like BlueScope Steel and Liberty Primary Metals Australia.

Trade tensions add pressure to steelmakers

Australia’s producers have also come under pressure from the United States, with President Donald Trump reinstating and expanding Section 232 tariffs in mid-2025. Steel import duties doubled from 25% to 50%, while aluminium tariffs also surged. BlueScope Steel’s US subsidiary benefited as local prices rose, but Australian-made exports were caught in the crossfire. The Australian Government has so far failed to secure an exemption, raising concerns for manufacturers like Liberty Primary Metals Australia and InfraBuild, which have operations or supply chains exposed to the US market. These trade tensions are just one part of a broader wave of geopolitical instability that's reshaping global supply chains and pricing dynamics for Australian manufacturers.

War, trade and defence spending shift manufacturing dynamics

Ongoing conflicts, from the Russia-Ukraine war to renewed flare-ups in the Middle East, have driven unprecedented swings in prices for commodities, particularly steel, aluminium and energy feedstocks. Meanwhile, US-China tech and trade disputes continue to disrupt semiconductor and electronics supply chains, forcing Australian manufacturers to contend with longer lead times and higher landed costs.

These dynamics have fed directly into revenue volatility among the top 100 metals, machinery and chemicals manufacturers. Caterpillar Holdings Australia Pty Ltd (73rd), a major supplier of heavy industrial equipment, recorded a 16.1% drop in revenue in 2024, while Southern Steel Group Pty Ltd (57th), exposed to steel price fluctuations, saw its revenue fall 13.5% over the year.

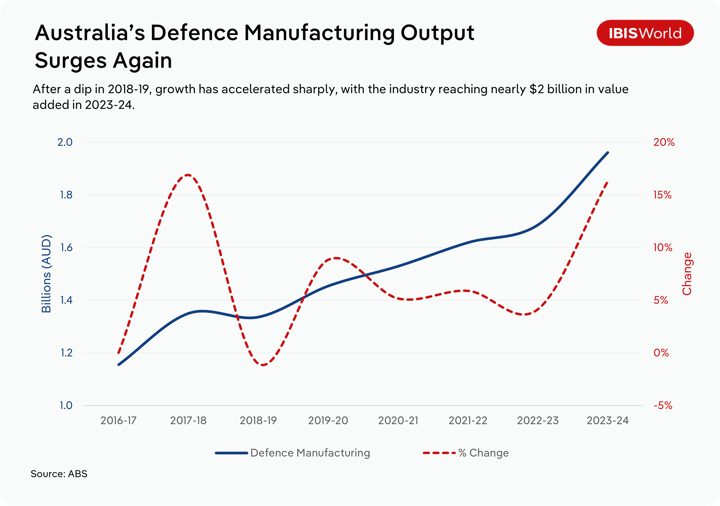

Australia’s ramp-up in defence procurement under AUKUS and broader force modernisation programs has buoyed homegrown contractors. BAE Systems Australia Holdings Limited (40th) and Thales Australia Holdings Pty Ltd (55th) feature in the Top 100, both posting double-digit growth as contracts for submarines, ship patrol vessels and electronic warfare systems flowed through. Given the multidecade nature of Australia’s defence investment pipeline, including the AUKUS nuclear submarine program and expanding sovereign shipbuilding targets, growth in this segment is set to be sustained well into the next decade.

While external demand drivers like defence spending continue to shape some manufacturers’ performance, internal efficiency strategies (especially automation) are becoming just as critical.

Cutting costs, raising output: AI’s role in manufacturing

Various enterprises across Australia’s manufacturing sector have invested in AI and automation initiatives, aiming to optimise their operations and significantly reduce expenses associated with employee wages. In particular, the Meat Processing industry has capitalised on automation within its operations, including two well-performing manufacturers, Industry Park Pty Ltd (9th) (trading as JBS Australia) and Thomas Foods International Consolidated Pty Limited (26th), which achieved revenue boosts of 5.6% and 18.2%, respectively.

Thomas Foods International leads automation gains

Adopting automation to improve efficiency while reducing operational expenses has been a common trend in the Meat Processing industry, and this has undoubtedly been the case for top meat processors like Thomas Foods International. The company’s new Murray Bridge processing plant, completed in May 2023, features Dematic’s Multishuttle Meat Buffer and Pallet Automated Storage and Retrieval System, enabling stock transfer using automated guided vehicles that can navigate frozen and chilled environments.

By streamlining operations and creating a sustainable local supply chain method through automation, Thomas Foods International, along with other similar meat processing entities, has gained significant momentum in the industry, helping to lift profit margins by cutting costs and mitigating labour risks.

As automation and AI implementation ramp up across the Meat Processing industry, companies pursuing cost-cutting efforts will continue to benefit from improved efficiency by streamlining operations, leading to higher throughput. Companies like JBS Australia and Thomas Foods International are beginning to see tangible benefits from their investments in automation.

Broader industry adoption remains uneven

Looking across the industry, JBS Australia is trialling fully automated beef-boning systems under the LEAP4Beef program at its Brooklyn facility in Victoria, marking a major step towards robotic precision in meat processing. Similarly, Teys Australia Pty Ltd (29th) has invested in automated inventory management and robotics at its $100 million Port of Brisbane distribution centre.

Meanwhile, Midfield Group (58th) has implemented a first-of-its-kind back‑end automation system that handles boxed product all the way to pallet without manual intervention. These moves reflect a growing industrywide pivot to automation to boost efficiency, enhance traceability and reduce labour dependency. Although many major players are beginning to ramp up their investments in automation, several smaller processors have yet to adopt these technologies, highlighting ongoing variance in capacity and scale.

Final Word

The top 100 manufacturers in Australia in 2024, spanning 62 industries, had varying performances. Pharmaceutical companies once again came out on top, thriving off the support of increased R&D investments that enable the development of new and improved medicines to treat various diseases. Given Australia's ageing population, the increased demand for these products comes as no surprise.

In the Meat Processing industry, manufacturers’ strong adoption of AI and automation processes, along with investments in research and development initiatives, led to soaring revenue growth over the year. The Meat Processing industry is increasingly turning to automation and digitalisation to navigate labour shortages and rising operational costs, with several major players – like JBS Australia, Teys Australia and Thomas Foods International – investing in robotic systems, automated handling lines and smart inventory infrastructure in recent years. These innovations are helping reduce reliance on manual labour while boosting efficiency and traceability across the supply chain.

Iron smelting and steel manufacturers experienced revenue falls due to the global transition towards green steel practices, which has reduced demand for Australia’s low-grade iron ore. This decline in demand has placed sustained downwards pressure on iron ore prices, contributing to revenue slumps for companies like BlueScope Steel and InfraBuild. The Iron Smelting and Steel Manufacturing industry is at a critical juncture: traditionally an exporter of bulk, low-carbon steel, it is having to modernise rapidly or risk being outcompeted. While green steel technologies offer a promising future, progress remains slow, and costs high.