Key Takeaways

- Construction, healthcare and education are under pressure as staffing costs rise faster than revenue.

- Labor can account for up to 70% of operating costs, putting margin strain at the center of credit risk.

- Borrowers with fixed pricing or funding caps are most exposed, even when topline growth looks strong.

- Smarter loan structuring means factoring in workforce dynamics, not just financial performance.

In the years following the pandemic, rising wages were initially viewed as a necessary correction. Labor markets tightened, job vacancies surged, and many sectors raced to attract or retain talent. But as wage growth outpaces revenue growth in key labor-heavy sectors like healthcare, construction and education, it’s no longer just a cost of doing business; it’s becoming a constraint on credit.

Across the globe, industries with high labor dependency are grappling with wage inflation driven by structural constraints: ageing populations, long training timelines, stalled migration and limited automation potential. In many cases, these businesses can’t pass rising costs on to customers quickly enough, resulting in sustained margin pressure.

This imbalance has a direct impact on debt capacity. Even borrowers with solid revenue may face deteriorating financial health, squeezed between climbing staffing costs and softening margins. These pressures often go undetected in traditional assessments focused solely on historical performance.

To safeguard portfolios, credit professionals need to understand which industries are most exposed, why wage inflation is proving so persistent, and how to factor this into smarter, more forward-looking loan structuring.

Where are the impacted sectors?

Some of the most credit-exposed sectors are also the most labor-intensive. From building sites to classrooms and clinics, staffing costs are rising sharply, but revenue isn’t always keeping pace. The following sector snapshots highlight where risk is building, and why lenders need to pay closer attention to workforce dynamics.

Construction

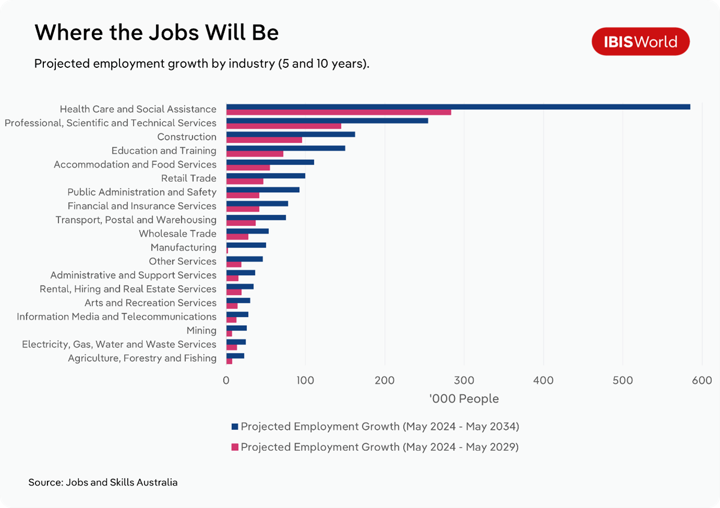

The global construction industry is entering a critical phase where labor availability and cost are becoming major constraints on output, especially in high-growth regions like Australia, the US, Canada and parts of Europe. Although construction pipelines remain strong, driven by housing demand, infrastructure investment and energy transition projects, employers are struggling to attract and retain skilled workers at the pace needed.

Australia

Tight conditions in national labor markets have driven construction wages upward, but not all firms can pass these costs on to clients. In Australia, for example, forecasts indicate a continued shortage of up to 90,000 construction workers by 2029, with industry-level wages rising well above historical averages. Smaller or mid-sized contractors, who often operate on thin margins and fixed-price contracts, are most exposed. Prolonged cost blowouts can erode profitability and delay project delivery, deteriorating cash flow and weakening repayment capacity.

US

In the US, similar trends are taking shape. Construction wages are rising faster than output prices in many metro areas, particularly in public infrastructure and housing development. Firms that expanded headcount rapidly during the post-pandemic recovery now face the challenge of retaining skilled labor amid rising payroll pressures and unpredictable material costs. This places a growing strain on operating margins, increasing the likelihood of covenant breaches or refinancing difficulties for borrowers with high leverage.

Lending implications

Lenders and credit analysts must assess whether borrowers in this space have sufficient buffers, either through pricing power, flexible contracts or diversified labor sourcing, to withstand continued wage escalation. For those that don’t, liquidity risks may begin to outweigh project pipeline strength.

Healthcare and Aged Care

No sector has been hit harder by the labor supply crunch than healthcare and aged care. Across developed economies, these industries face a convergence of structural pressures:

- Ageing populations driving demand.

- An ageing workforce accelerating attrition.

- A global shortage of trained staff.

These factors are inflating labor costs in ways that are proving difficult to control.

Australia

In Australia, aged care providers are contending with mandatory wage increases introduced following the Fair Work Commission’s 2023 decision, which raised award wages by 15% for direct care workers. While necessary to improve workforce retention, these changes have significantly increased operating costs for providers already constrained by fixed government funding. Many now face tighter margins, with limited ability to offset rising expenses through service pricing.

US and UK

Similar dynamics are playing out in the US and UK. Nursing homes and hospitals continue to report chronic staff shortages, with organizations relying heavily on agency workers to fill gaps. This is a costly workaround that drives payroll expenses even higher.

Germany

In Germany, where healthcare worker shortages are among the most acute in the EU, the government is expanding recruitment efforts abroad. However, the long credentialing process and language barriers mean short-term relief remains limited.

Lending implications

Healthcare and aged care businesses often operate under funding models (public, private or hybrid) that cap their revenue growth. When labor costs rise independently of these funding structures, margin compression can be rapid and severe. For lenders, this introduces a layer of vulnerability not always evident in traditional credit assessments. Even businesses with steady demand and stable occupancy rates may struggle to meet obligations if staffing expenses continue to climb.

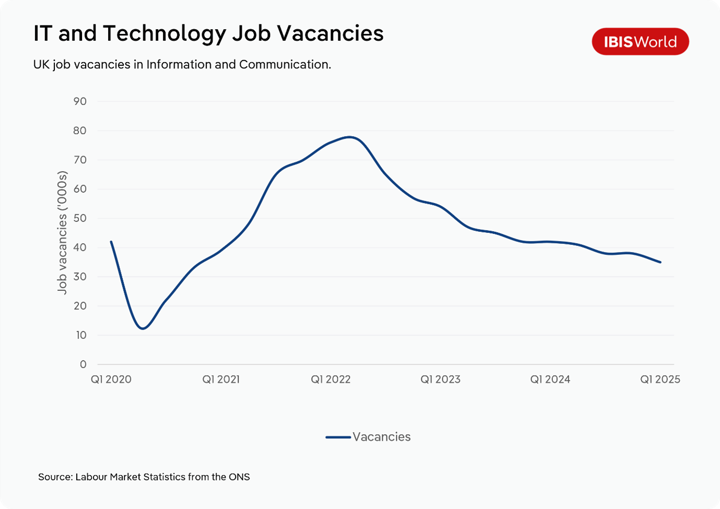

ICT and Professional Services

While often seen as high-growth and high-margin, ICT and professional services firms are increasingly vulnerable to labor cost pressures, especially in regions where talent is scarce and competition for skilled workers is intense.

US and UK

In the US and UK, the tech sector experienced a hiring surge during the pandemic recovery, followed by widespread layoffs in 2023 and 2024. But this correction hasn’t resolved long-term capacity constraints. Specialist roles in data science, cybersecurity and AI remain in short supply, keeping wage growth elevated for in-demand skillsets.

Australia

In Australia, despite high-profile layoffs in global tech firms, average salaries across ICT occupations continue to rise, driven by public sector digitization, cloud migration projects and demand from non-tech industries modernizing internal systems.

Consulting and professional services firms face a similar squeeze. Labor is their primary input, but unlike tech platforms, they often can’t scale delivery without hiring. The result is a persistent trade-off between growth and margin. Staff costs have risen sharply, particularly for mid-level roles, as firms compete for talent with both industry and government.

While revenue in these sectors remains strong in many markets, the decoupling of revenue and labor costs poses a strategic risk. When wage growth outpaces billable rate increases or client willingness to absorb higher fees, profit margins narrow and operating leverage declines. The result is a more fragile financial profile, particularly for smaller firms without pricing power or long-term contracts.

Lending implications

For lenders, it’s not enough to see topline growth. Understanding headcount trends, salary band changes and billability assumptions is critical to assessing borrower sustainability in these sectors.

Education and Training

Education providers are facing mounting labor cost pressures without the flexibility to increase revenue at the same pace. In many regions, particularly across Australia, the UK and the US, wage growth for educators and support staff is being driven by union negotiations, policy reforms and persistent shortages.

Australia

In Australia, early childhood educators have seen substantial wage increases through both award changes and government subsidies designed to stem attrition. While these measures aim to improve quality and stability in the sector, they have also increased cost burdens for providers, especially those operating outside publicly funded models. In the tertiary space, caps on international student numbers are dampening a major revenue stream, just as universities and colleges face higher payroll costs and increased expectations around student support.

US and UK

Similar trends are emerging globally. In the US, districts are boosting teacher pay to retain staff amid widespread burnout and early retirements, yet many remain underfunded. In the UK, further education colleges face escalating wage demands but limited funding uplifts, leaving little room to absorb new cost pressures. Meanwhile, workforce development programs (crucial for retraining workers in high-demand industries) are competing for limited public funding despite rising delivery costs.

Lending implications

Unlike commercial sectors, education providers typically operate under rigid pricing structures set by regulation or funding bodies. That leaves little room to adapt when wage costs rise sharply. For lenders, this means even well-established institutions can become financially strained, especially when wage hikes are sudden or unaccompanied by increased enrolment or funding.

What are the global drivers behind the wage pressure?

The financial strain seen across labor-intensive industries is not a temporary anomaly. It reflects a convergence of global pressures that are reshaping wage expectations and labor availability across advanced and emerging economies alike.

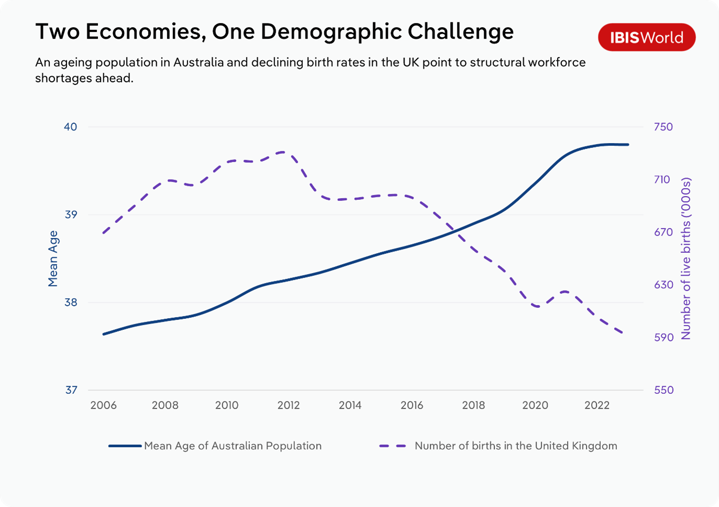

Demographic headwinds are mounting

In high-income countries, ageing populations are shrinking the labor pool while increasing demand for health and care services. OECD data shows that by 2035, nearly one-third of the population in countries like Japan, Germany and Italy will be over 65. At the same time, declining birth rates and stalled workforce participation are limiting the inflow of younger, lower-cost workers, thereby intensifying competition for talent and pushing up wages in essential services.

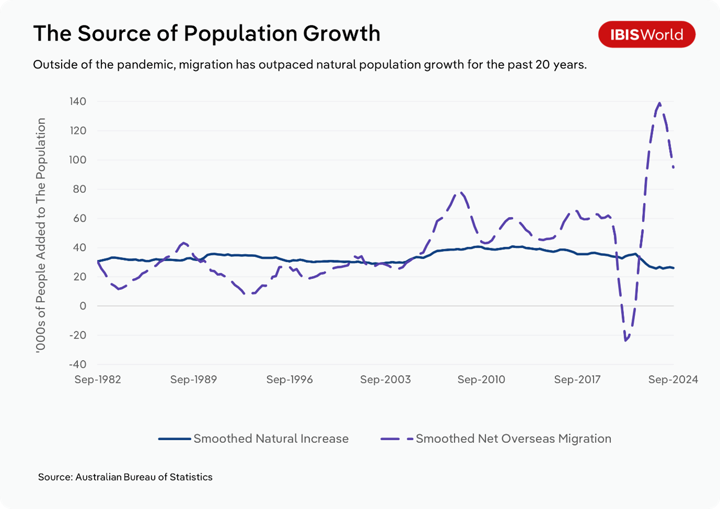

Immigration pressures are intensifying

Traditionally, migration has helped offset domestic labor shortages, particularly in sectors with long training pipelines or undesirable working conditions. But political constraints and infrastructure bottlenecks are limiting this option.

In Australia, for instance, renewed migration targets have been met with planning backlogs and housing capacity concerns, stalling the benefits. Similar tensions are playing out in the UK, Canada and parts of the EU.

The skills mismatch is structural, not cyclical

As industries digitize and automate, the need for higher-skill workers has increased. But education and training systems in many economies have been slow to align with this shift. The World Economic Forum estimates that by 2030, over 1 billion people globally will need reskilling, yet many governments and employers are underinvesting in workforce transition. This mismatch is forcing businesses to raise wages in a shrinking pool of qualified talent while absorbing the cost of on-the-job upskilling.

Private and public sectors are competing for the same workers

As fiscal pressure drives public investment into infrastructure, health and education, governments are hiring at scale. This adds further tension to sectors already contending with wage pressures. In the US, the Bipartisan Infrastructure Law and Inflation Reduction Act have expanded hiring programs that now overlap with key private-sector needs, from civil engineers to technicians. Similar hiring waves are playing out across Europe and Asia, with governments offering stability and long-term contracts that private firms struggle to match.

These forces are driving labor costs up across borders and across industries. While local conditions and sector dynamics vary, the direction of travel is consistent: wage inflation is becoming a global constant that lenders and business planners can no longer treat as a short-term fluctuation.

How to structure smarter loans in a labor-constrained economy

As labor costs outpace revenue in key sectors, traditional credit models are struggling to keep up. Borrowers may present solid topline performance, but their profitability and cash flow resilience are quietly eroding, especially in labor-intensive industries with tight margins or rigid pricing.

The gap between labor cost growth and revenue expansion isn’t just squeezing margins, it’s also changing how lenders should evaluate risk. Historical performance alone can mask fast-developing vulnerabilities tied to rising staffing costs.

To protect portfolio health, lenders must integrate workforce exposure into their credit assessments and adjust loan structures accordingly.

Why labor costs matter more than ever

In many sectors, wages already account for 40–70% of operating costs. When those wages rise 5–10% year-on-year and revenue doesn’t follow, even well-established businesses can struggle to maintain coverage ratios.

Traditional models that lean heavily on historical data may miss this shift until it’s too late.

What to watch for:

- Labor cost growth outpacing revenue or output.

- Margins that are already thin, or tied to capped funding or pricing models.

- Early signs of workforce stress, like rising attrition, heavy reliance on contractors or wage blowouts.

When staffing costs climb unexpectedly, businesses may delay supplier payments, reduce maintenance or stretch existing teams. This can lead to operational disruptions, reputational damage, and a weakening of overall borrower quality.

Even in high-growth industries like ICT or education, borrowers may face:

- Delayed project delivery.

- Cash flow issues that lead to default or refinancing risk.

These risks vary across borders. Labor intensity, wage growth, and workforce availability differ widely between markets. A healthcare operator in Germany may face vastly different staffing challenges and costs than one in Canada or Australia, even with similar services and structures. That makes cross-border comparisons more complex and underscores the need for regional context.

Embed workforce risk into credit assessment

Topline performance can mask rising vulnerability levels. To avoid surprises, lenders should embed workforce exposure directly into their credit frameworks by making it a core part of early-stage borrower evaluation.

Go beyond financials by asking

- What share of expenses goes to payroll, and how does that compare to industry norms?

- How exposed is the business to sudden wage growth in key roles?

- Are they over-reliant on short-term labor solutions, like agency staffing or contractors?

Additional strategies

- Stress-test scenarios with 5–10% wage increases for critical roles.

- Review attrition rates and headcount fluctuations as leading indicators of workforce strain.

- Assess retention strategies or automation initiatives that may help contain long-term cost growth.

Calibrate loan terms to match labor volatility

Where borrower exposure is high, loan structures should reflect that. Rising staffing costs can flip a healthy borrower into risk territory.

Key options for lenders

- Shorten loan tenures or include more frequent review milestones for high-exposure sectors.

- Tie covenants to labor-related ratios (like wages-to-revenue) or margin thresholds.

- Ask for detailed cost control plans, particularly in sectors where wages are climbing faster than revenue.

Reward resilient workforce strategies

Not all borrowers are equally exposed. Some are actively managing risk through internal training, workforce planning, and process improvement.

Signs of a resilient operator

- Clear retention or upskilling initiatives to reduce hiring churn.

- Process digitization or role redesigns that lower reliance on scarce talent.

- Contingency plans that diversify sourcing or reduce single points of labor failure.

These borrowers are often better placed to withstand wage shocks and staffing shortfalls. In some cases, their forward planning and adaptability may justify more flexible loan terms or support through temporary pressure points.

Final Word

Labor cost pressures are shifting the ground beneath traditional credit models. In sectors where people power drives performance, rising wages are quietly eating into margins, cash flow and delivery capacity.

Borrowers that appear healthy on the surface may already be under strain, especially in industries with tight pricing, thin buffers, or limited flexibility.

Lenders who dig deeper into wage exposure and workforce strategy will be better equipped to assess risk and support strong operators. By factoring labor dynamics into loan structuring now, lenders can protect their portfolios and strengthen their position as strategic partners in a more constrained economy.