As high inflation and rising interest rates take a toll on consumers and businesses, the housing market has slowed, a trade deficit occurred and inventories have remained low; this has resulted in the US economy to contract for a second consecutive quarter, bringing an end to COVID-19 (coronavirus) pandemic recovery.

Driving concerns of a recession, real GDP has been adjusted to decrease at an annualized rate of 0.9% in the second quarter of 2022.

Despite the decline, the National Bureau of Economic Research Business Cycle Dating Committee has indicated that the economy is not yet in a recession since the labor market has continued to expand and personal consumption expenditures are up.

While these indicators point to positivity, the economy continues to experience challenges regarding high inflation, weakened consumer sentiment and ongoing supply chain disruptions, intensifying recession fears moving forward.

Labor market

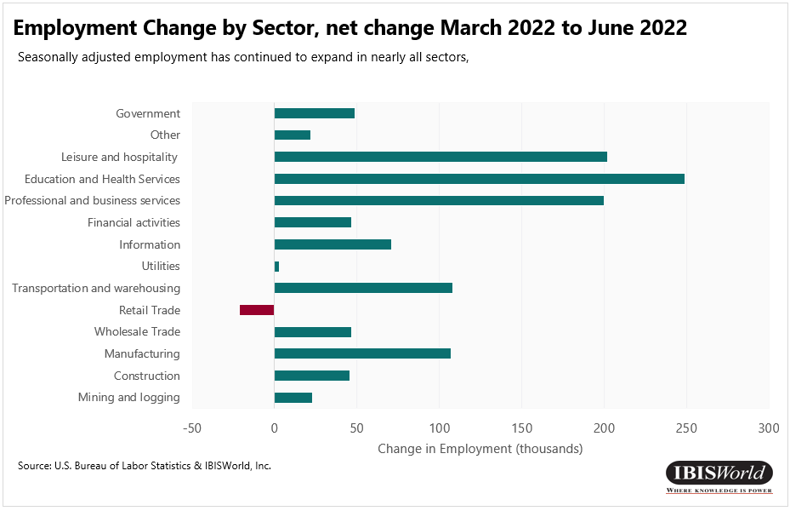

- Total nonfarm employment increased by 1.2 million during the second quarter of 2022, followed by another 528,000 jobs added in July 2022. The Education and Health Services sector was the largest contributor to growth, adding 122,000 jobs in July, followed by the Leisure and Hospitality sector, which added 96,000 jobs in July.

- As offices have reopened, the share of remote workers has continued to decline to 7.1% during Q2 2022, down from 10.0% in March 2022. However, this varies significantly by sector and job requirements, with the Information sector holding the largest share of remote employees, followed by Professional, Scientific and Technical Services.

- The unemployment rate reached prepandemic levels of 3.5% in July. Although the unemployment rate has recovered, the labor force participation rate is still below prepandemic levels.

- Across the United States, average hourly wages increased during Q2 2022. However, wages in the Wholesale Trade sector declined. Despite continued high inflation, real average hourly earnings increased in July while remaining well below the levels experienced in July 2021.

Consumer spending

- Total personal consumption expenditures (PCE) grew 5.5% during the second quarter of 2022. Meanwhile, year-over-year PCE increased 8.4% as of June 2022. Consumer spending growth has largely been driven by spending on nondurable goods, specifically spending on gasoline and other energy goods as well as household consumption expenditures (for services).

- Spending on durable goods increased only slightly during Q2 2022, rising 0.2%. Within the durable goods segment, spending on motor vehicles and parts and furnishings and durable household equipment increased 0.9% and 1.1% during Q2 2022, respectively. Conversely, spending on recreational goods and vehicles and other durable goods decreased 0.5% and 2.0% during the same period, respectively.

- Spending on nondurable goods has also increased during Q2 2022, driven primarily by spending on gasoline and other energy goods increasing 5.3% during the same period. Additionally, spending on food and beverages purchased for off-premises consumption increased 0.7% during Q2 2022.

- Spending on services increased 2.2% during Q2 2022. Increasing consumption of transportation services (5.5%) and food services and accommodations (3.5%) drove spending on services to increase during Q2.

Inflation

- Personal Consumption Expenditures price index (excluding food and energy), the Federal Reserve’s preferred inflation measure, increased 1.3% during the second quarter of 2022. Consequently, year-over-year inflation stands at 4.8% for the year ending in June 2022.

- Inflation, as measured by the Consumer Price Index (CPI) and including food and energy items, increased 8.5% for the year ending July 2022. The CPI is often the more common inflation figure among consumers since food and energy are major spending categories for households.

- The CPI decreased slightly in July 2022 compared with June, driven primarily by the energy index decreasing 4.6% in July, which followed an increase of 7.5% in June. Further, the gasoline index decreased 7.7% and the index for natural gas decreased 3.6% in July 2022. However, the electricity index increased 1.6% in July.

- The Russian invasion of Ukraine and pandemic-related lockdowns in China have further exacerbated supply chain issues in Q2, placing upward pressure on commodity prices and also contributing to inflation.

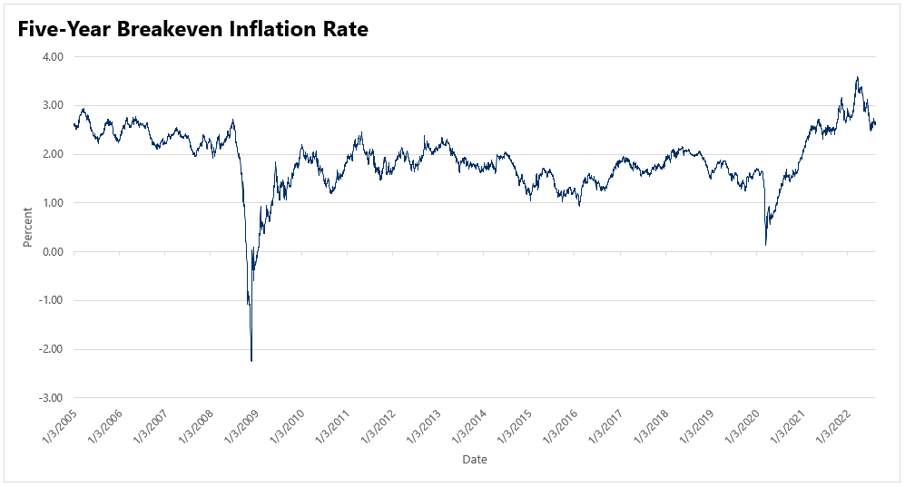

- To combat the historic rise in inflation, the Federal Reserve has increased interest rates in 2022, with President Biden signing the Inflation Reduction Act of 2022 into law. However, the Congressional Budget Office does not expect any significant change in inflation as a result of this new law.

Residential trends

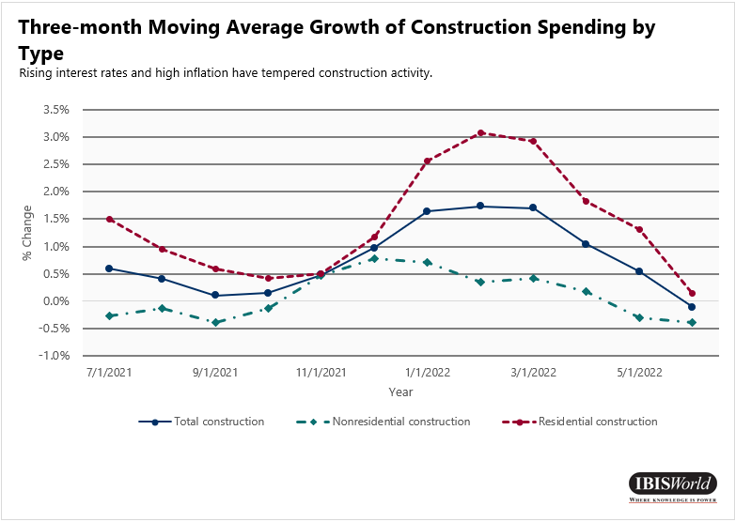

- Despite strong growth in the first half of 2022, the value of residential construction fell in June. Although remaining above prepandemic levels, the construction of new housing units slowed significantly as well, with an estimated 1.7 million homes under construction.

- While single-family home construction has fallen consistently during Q2 2022, multifamily construction has increased slightly. Overall, builders have been able to respond to weakening demand as interest and mortgage rates increase, decreasing the affordability of new housing. Meanwhile, high rent costs continue to be an opportunity for builders to rent out multifamily units.

- As mortgage rates have been mainly on the rise, US mortgage applications have decreased on average in 2022, as demand for loans to purchase homes and refinancing activity has fallen. Although mortgage rates declined slightly for the week ending August 12, 2022, applications still declined, with consumers concerned about inflation and homes retaining value further fueling recession fears.

Nonresidential trends

- Nonresidential construction is down 1.2% during the second quarter of 2022, driven largely by power, highway and street and religious construction. Water supply construction has continued to exhibit strong growth, driven by increasing manufacturing and industrial output.

- Commercial and industrial loans have increased at an accelerated rate during Q2 2022 compared with Q1, indicating increased investment in plant and equipment and working capital.

- With the passing of the Infrastructure Investment and Jobs Act (IIJA), construction activity for projects such as reducing carbon emissions, repairing bridges and expanding electric vehicle charging infrastructure is expected to strengthen. Furthermore, the Inflation Reduction Act, passed in August 2022, includes various tax credits and funding for energy and climate projects, which will further enable construction activity.

Financial markets

- The Federal Reserve has continued its monetary tightening stance by raising the target range for the federal funds rate to 1.5% to 1.75%. The Federal Funds Effective Rate currently sits at 1.68%. In addition, the Federal Open Market Committee (FOMC) began to significantly reduce its securities holdings starting June 1, 2022. By selling security holdings, the FOMC aims to decrease the money supply within the economy. Its goal is to reel in runaway inflation, driven by high retail food and energy prices, by raising the effective federal funds rate and selling securities. Additional rate hikes are anticipated to continue until the FOMC can reel inflation toward its target of 2.0%.

- Fears of recession weigh heavy on investors’ minds as they seek to unload risky assets. Recession fears are led by increased inflation, which has led the Fed to continue to raise interest rates and a slowdown in US GDP growth. A brief market rally occurred alongside the selloff of US government bonds, in turn increasing the yield on the 10-year Treasury note.

- As of July 2022, the S&P 500 was down 14.5%, NASDAQ down 20.0% and DIJA down 11.1% from the start of the year. Investors continue to keep tabs on inflation to access how severe the Fed’s policy changes will be each meeting. Volatility in the market is anticipated to continue until the Fed’s monetary policy shows signs of slowing inflation.

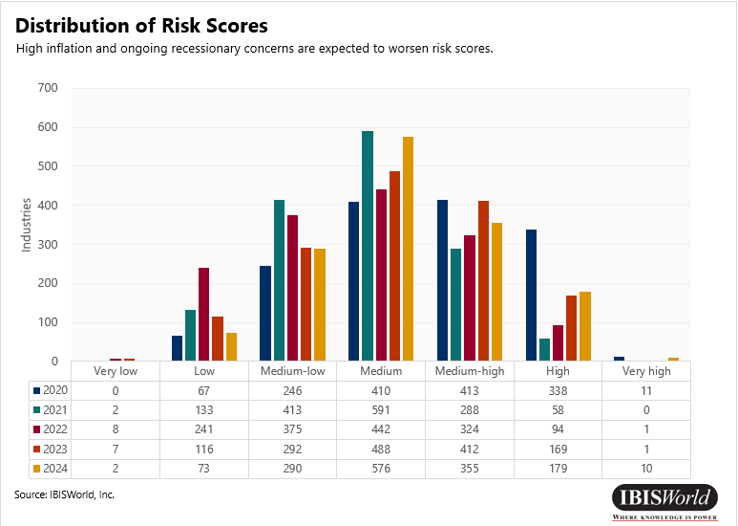

Distribution of risk ratings

- Risk in 2020 was concentrated at the higher end of the scale due to the onset of the coronavirus pandemic.

- 3.0% of industries rated as medium-high or greater risk.

- Risk in 2021 tempered as restrictions largely ease.

- 3.0% of industries rated as medium-high or greater risk

- The risk outlook is expected to worsen due to mounting inflation, recession concerns and ongoing supply chain issues

- 2.0% of industries rated as medium-high or greater risk in 2022.

- 2.0% of industries rated as medium-high or greater risk in 2023.

Sector highlights

- Accommodation and Food Services – The Accommodation and Food Services sector went from the riskiest sector in 2020 and 2021 to one of the least risky in 2022, driven by a rebound in economic activity and travel. Despite inflation contributing to higher operating costs for these establishments, eased pandemic-related restrictions are expected to benefit industries such as Chain Restaurants, Bars and Nightclubs and Single Location Full-Service Restaurants.

- Transportation and Warehousing – With a quick return to travel, the Transportation and Warehousing sector is expected to be impaired by supply and demand imbalances, driving up fuel costs. While some operators may pass along price changes to key markets, others may cut into profitability. Nevertheless, this sector is expected to be one of the least risky in 2022, driven by increased demand.

- Construction – As interest rate hikes raise borrowing costs for construction projects, construction is expected to be one of the riskiest sectors in 2022 and during the outlook period. However, funding from the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act are expected to bolster nonresidential construction activity over the coming years. In particular, the Water and Sewer Line Construction; Road and Highway Construction; and Bridge and Elevated Highway Construction industries are anticipated to benefit from added funding and tax credits.

- Retail Trade– Consumer spending increased for nondurable goods, particularly for gas and food, driven by rising prices and inflation. As spending on such items increases, the Gas Stations industry and the Gas Stations with Convenience Stores industry have exhibited revenue growth, particularly as operators have passed price hikes onto consumers. Similarly, rising food prices have boosted revenue for the Supermarkets and Grocery Stores industry.