IBISWorld Platform

Answer any industry question in minutes with our entire database at your fingertips.

Demand conditions for the Kitchen and Cookware Stores industry have been relatively weak. Discretionary income growth has been slow, and consumer sentiment has been volatile and remains negative. Consumers have been less likely to spend money on kitchen and cookware products, particularly as cost-of-living pressures and inflation have mounted over the past few years. Instead, consumers are opting to buy more affordable products from discount department stores like Kmart, Target and the Reject Shop, leaving little room for kitchen and cookware stores to salvage their falling profit margins. Even though an appreciating Australian dollar has made it more affordable for retailers to acquire imported goods, discount department stores have been reaping the same benefits and, thanks to their significant economies of scale, can offer even lower prices for their kitchen and cookware goods.

Answer any industry question in minutes with our entire database at your fingertips.

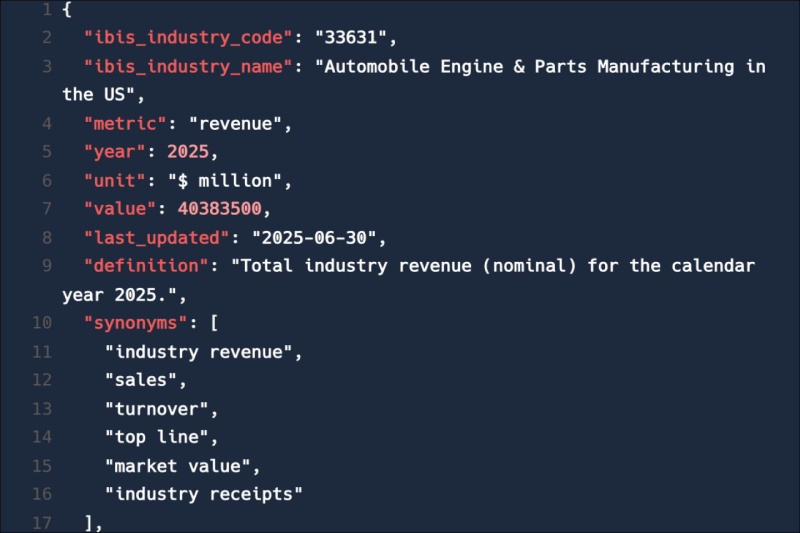

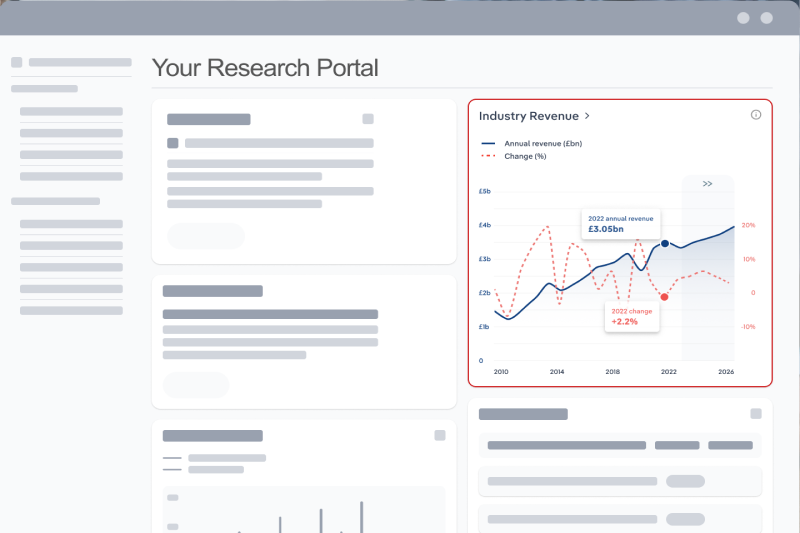

Feed trusted, human-driven industry intelligence straight into your platform.

Streamline your workflow with IBISWorld’s intelligence built into your toolkit.

IBISWorld's research coverage on the Kitchen and Cookware Stores industry in Australia includes market sizing, forecasting, data and analysis from 2015-2030. The most recent publication was released December 2025.

The Kitchen and Cookware Stores industry in Australia operates under the ANZSIC industry code OD4011. Industry retailers sell kitchenware and cookware like pots and pans, bakeware, knives and utensils. Retailers buy these items from manufacturers and wholesalers based domestically or offshore and then sell them on, mainly to consumers. Department stores, supermarkets and pure-play online retailers are excluded from the industry. Related terms covered in the Kitchen and Cookware Stores industry in Australia include point of sale, free trade agreement and cooking utensils.

Products and services covered in Kitchen and Cookware Stores industry in Australia include Cookware, Bakeware and Kitchen knives and cooking utensils.

Companies covered in the Kitchen and Cookware Stores industry in Australia include Global Retail Brands.

The Performance chapter covers detailed analysis, datasets, detailed current performance, sources of volatility and an outlook with forecasts for the Kitchen and Cookware Stores industry in Australia.

Questions answered in this chapter include what's driving current industry performance, what influences industry volatility, how do successful businesses overcome volatility, what's driving the industry outlook. This analysis is supported with data and statistics on industry revenues, costs, profits, businesses and employees.

The Products and Markets chapter covers detailed products and service segmentation and analysis of major markets for the for the Kitchen and Cookware Stores industry in Australia.

Questions answered in this chapter include how are the industry's products and services performing, what are innovations in industry products and services, what products or services do successful businesses offer and what's influencing demand from the industry's markets. This includes data and statistics on industry revenues by product and service segmentation and major markets.

The Geographic Breakdown chapter covers detailed analysis and datasets on regional performance of the Kitchen and Cookware Stores industry in Australia.

Questions answered in this chapter include where are industry businesses located and how do businesses use location to their advantage. This includes data and statistics on industry revenues by location.

The Competitive Forces chapter covers the concentration, barriers to entry and supplier and buyer profiles in the Kitchen and Cookware Stores industry in Australia. This includes data and statistics on industry market share concentration, barriers to entry, substitute products and buyer & supplier power.

Questions answered in this chapter include what impacts the industry's market share concentration, how do successful businesses handle concentration, what challenges do potential industry entrants face, how can potential entrants overcome barriers to entry, what are substitutes for industry services, how do successful businesses compete with substitutes and what power do buyers and suppliers have over the industry and how do successful businesses manage buyer & supplier power.

The Companies chapter covers Key Takeaways, Market Share and Companies in the Kitchen and Cookware Stores industry in Australia. This includes data and analysis on companies operating in the industry that hold a market share greater than 5%.

Questions answered in this chapter include what companies have a meaningful market share and how each company is performing.

The External Environment chapter covers Key Takeaways, External Drivers, Regulation & Policy and Assistance in the Kitchen and Cookware Stores industry in Australia. This includes data and statistics on factors impacting industry revenue such as economic indicators, regulation, policy and assistance programs.

Questions answered in this chapter include what demographic and macroeconomic factors impact the industry, what regulations impact the industry, what assistance is available to this industry.

The Financial Benchmarks chapter covers Key Takeaways, Cost Structure, Financial Ratios, Valuation Multiples and Key Ratios in the Kitchen and Cookware Stores industry in Australia. This includes financial data and statistics on industry performance including key cost inputs, profitability, key financial ratios and enterprise value multiples.

Questions answered in this chapter include what trends impact industry costs and how financial ratios have changed overtime.

The Industry Data chapter includes 10 years of historical data with 5 years of forecast data covering statistics like revenue, industry value add, establishments, enterprises, employment and wages in the Kitchen and Cookware Stores industry in Australia.

More than 6,000 businesses use IBISWorld to shape local and global economies

We were able to supplement our reports with IBISWorld’s information from both a qualitative and quantitative standpoint. All of our reporting now features some level of IBISWorld integration.

IBISWorld delivers the crisp business knowledge we need to drive our business. Whether it be serving up our major clients, winning new business or educating on industry issues, IBISWorld brings real value.

IBISWorld has revolutionised business information — which has proved commercially invaluable to exporters, investors and public policy professionals in Australia and overseas.

When you’re able to speak to clients and be knowledgeable about what they do and the state that they operate in, they’re going to trust you a lot more.

The market size of the Kitchen and Cookware Stores industry in Australia is $1.5bn in 2026.

There are 1,264 businesses in the Kitchen and Cookware Stores industry in Australia, which has declined at a CAGR of 0.2 % between 2020 and 2025.

The Kitchen and Cookware Stores industry in Australia is unlikely to be materially impacted by import tariffs with imports accounting for a low share of industry revenue.

The Kitchen and Cookware Stores industry in Australia is unlikely to be materially impacted by export tariffs with exports accounting for a low share of industry revenue.

The market size of the Kitchen and Cookware Stores industry in Australia has been declining at a CAGR of 3.1 % between 2020 and 2025.

Over the next five years, the Kitchen and Cookware Stores industry in Australia is expected to decline.

The biggest company operating in the Kitchen and Cookware Stores industry in Australia is Global Retail Brands

Kitchenware retailing and Cookware retailing are part of the Kitchen and Cookware Stores industry in Australia.

The company holding the most market share in the Kitchen and Cookware Stores industry in Australia is Global Retail Brands.

The level of competition is high and increasing in the Kitchen and Cookware Stores industry in Australia.